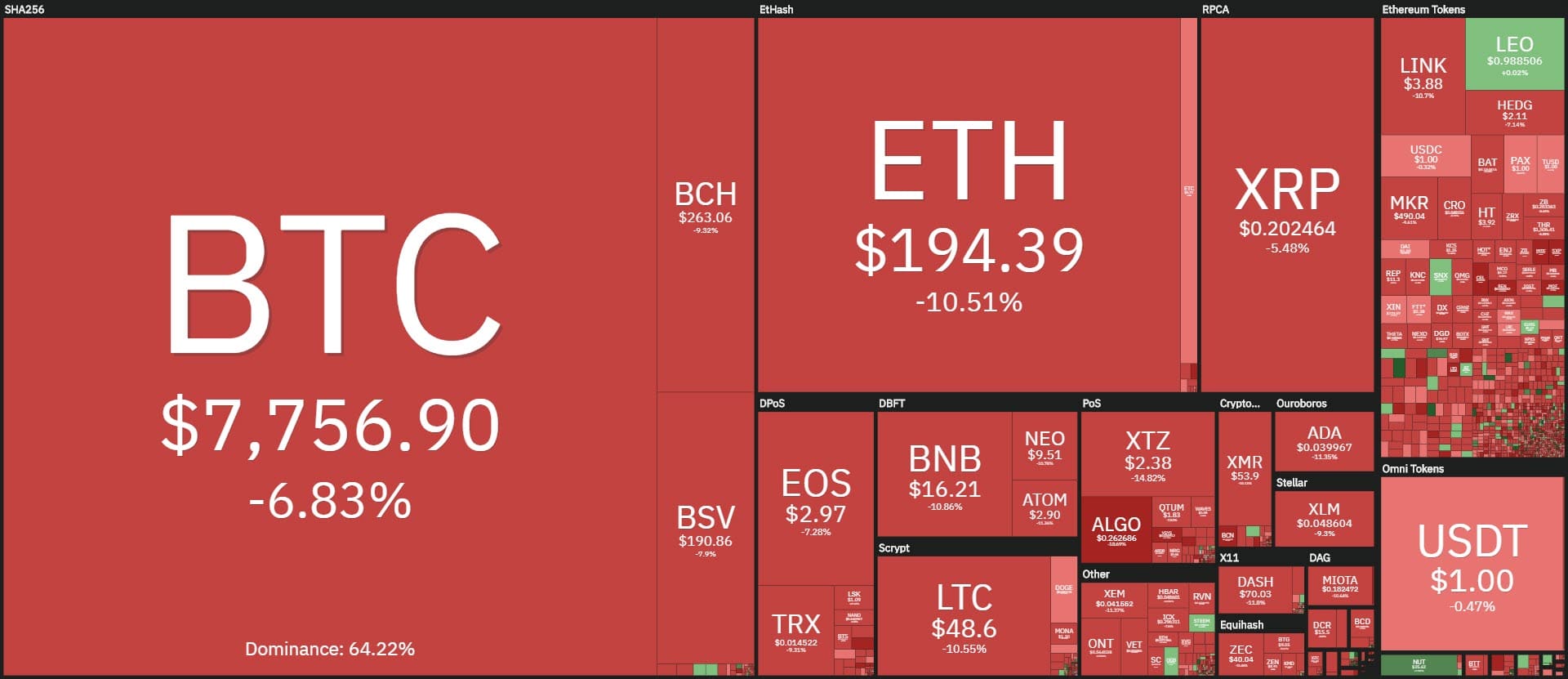

Today’s stock market crash does not benefit the cryptocurrency sector, especially Bitcoin, which is falling precipitously with double-digit declines. These losses are very similar to those of the stock markets and extend well over 10%. Among the top 100 this morning there was no positive sign.

The only one in positive territory marking just over 1% is Leo (LEO), slightly above 99 cents. Among the big ones, there are only double-digit declines. The only one that holds better among the top 30 is Chainlink (LINK) that with a drop of 6% is the one that loses the least of all and maintains the 11th position gained in recent days with the strong rises that have characterized its movement.

For the first time in its history, the cryptocurrency sector is facing a global crisis at the gates. Bitcoin was born during the height of the previous financial crisis, on January 3rd, 2009. It will be particular to understand the evolution and behaviour of cryptocurrencies and Bitcoin.

The drop of Bitcoin

During yesterday, Bitcoin broke the trendline and the dynamic bullish support that until yesterday confirmed the upward trend for over two months.

Therefore, it concludes the trend started from last December’s lows and lasted three months, with a bearish extension that in recent hours goes to test an important level of support, that of $7,800, which had given the first bullish impetus at the beginning of January triggering the rise that had earned the price even more than 40% with highs since the beginning of the year on February 13th, a few days before the stock market highs.

Given the current momentum for the cryptocurrency sector, at this time BTC is not confirming itself as a safe haven tool, so much so that in the last few hours it has totally decorrelated itself from gold with which it had had an almost specular trend since the end of December.

It will be interesting to understand the evolution of Bitcoin and cryptocurrencies in the coming weeks and evaluate if BTC can be a safe haven as the narrative has so far claimed.

In the last 48 hours, the volatility of Bitcoin has exploded with a daily movement of about 350%. Such an intense movement hasn’t been recorded since mid-December last year when prices reached their current low. The volatility coincides with the explosion of the U.S. VIX index, which reached 62 points, the highest level not recorded since December 2008.

For Bitcoin, it will be necessary to maintain the threshold of 7,800 dollars or go as high as 7,500. In case of a downward extension below these levels would cancel the rise built from mid-December to the top of February 13th.

The positive performance of Bitcoin is still the same as that of gold, both gaining about 9% since the beginning of the year, although it should be noted that from the highs of two weeks ago BTC was +40% since the beginning of the year.

Ethereum (ETH)

Ethereum is dragged down by this movement and, although it holds better the retracement at a technical level, still well away from the lows of the end of December, it is found in these hours to test the bullish trendline of 195 dollars. In these hours, in fact, ETH has broken the psychological threshold of the 200 dollars.

It will be necessary to confirm this hold unless it wants to align itself to the bearish movement of Bitcoin.