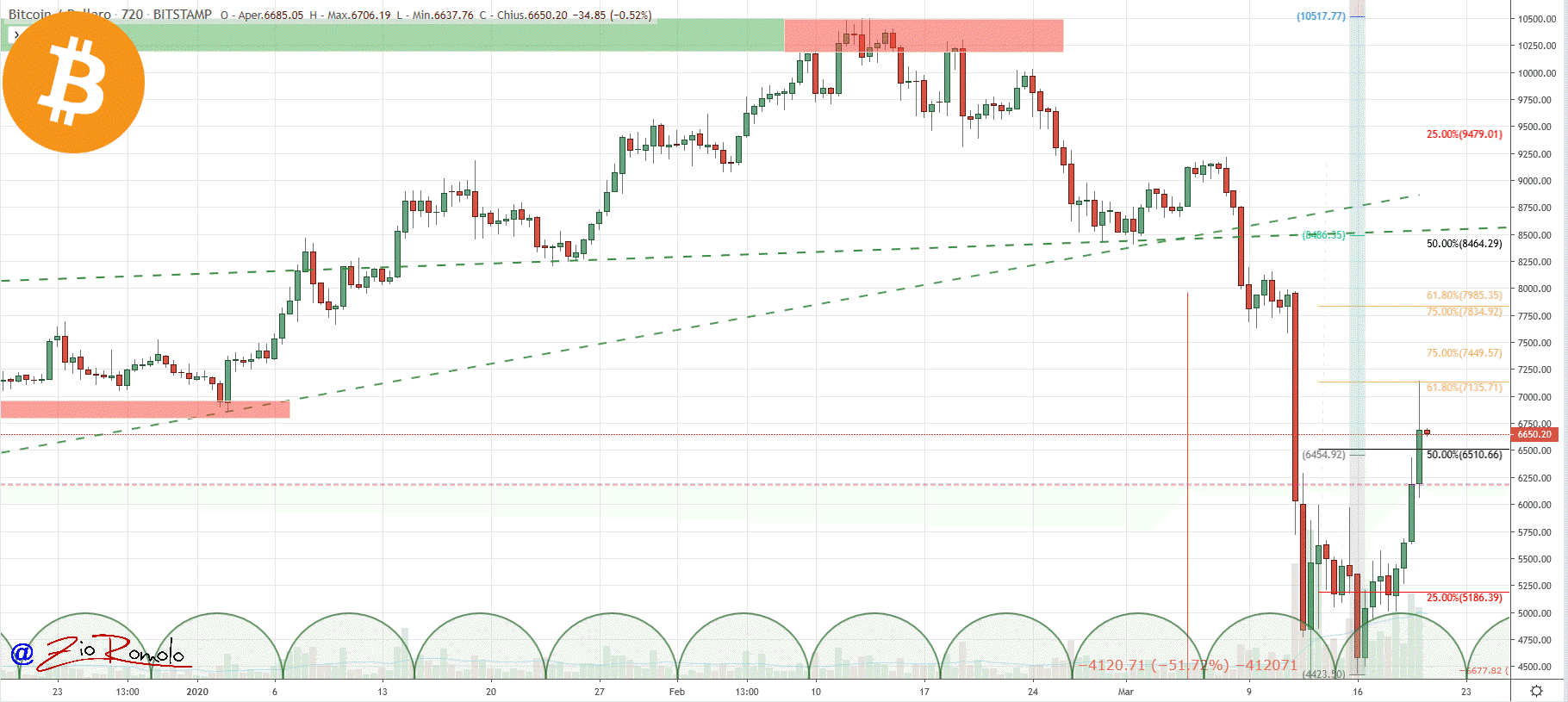

Bitcoin (BTC), for the second day in a row, has achieved a double-digit increase, something that has not happened since December 2017. A positive indicator that will have to be confirmed in the coming days over the weekend.

The strong jump sees Bitcoin prices recover more than 30% in two days, returning to major levels of support that have now become resistance, coinciding with the lows recorded between November and January. A rise that overwhelmingly brings Bitcoin’s capitalization back to $120 billion, dragging the total capitalization to a step from $190 billion.

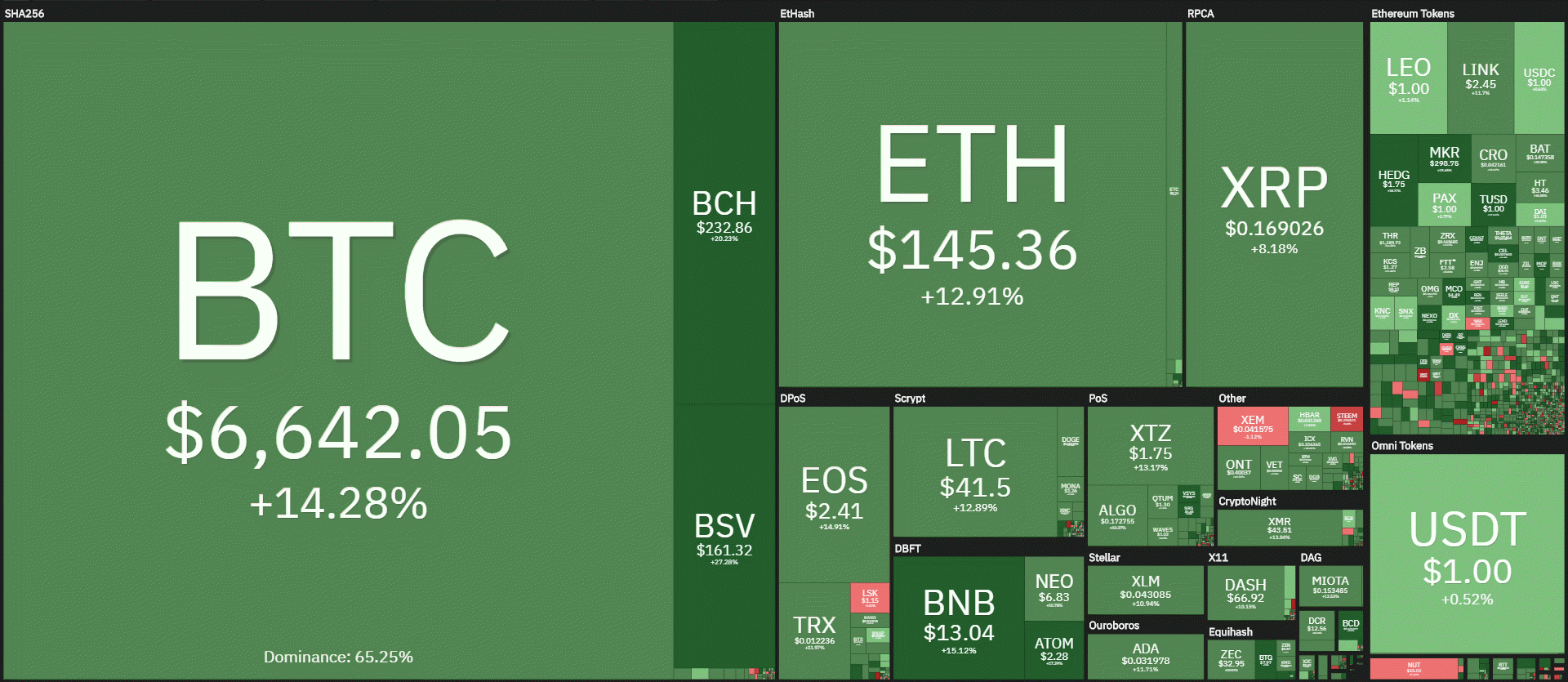

Overall, today is clearly a bullish day with all the first 100 in positive territory. There is only one red sign, that of Steem (STEEM) which, in contrast to yesterday, registers a -11%, but without affecting the strong bullish leap that yesterday saw it as the best of the day, with rises that in some moments have exceeded even 50%.

The rises that are being achieved by more than half of the first 100 cryptocurrencies are double-digit with jumps of up to 20%, making the weekly balance positive. Scrolling through the top 50 of the ranking of the most capitalized, all of them recover the positive territory.

It is a jump that shows a positive balance from the beginning of the year also for some of the major altcoins. Bitcoin still has a negative performance of -7% since the beginning of the year, XRP registers a -10%, while Ethereum (ETH), Bitcoin Cash (BCH), Tezos (XTZ) and Chainlink (LINK) score double-digit gains.

Chainlink and Tezos are rising again with prices trying to recover after the strong declines that overwhelmed them and after they had distinguished themselves with their performance for the first two months of 2020, until the first ten days of March.

From the lows of last week, they see performances close to 80% in the last few hours. For both of them, it is necessary to recover a few more percentage points to review the major resistance levels.

Volumes continue to show a doubling of what has been traded in the last 24 hours with an increase of more than 60%. It is Bitcoin that attracts attention with trades that in the last 24 hours exceed 3.5 billion, levels that have rarely been recorded. Yesterday, $25 billion of exchanges were recorded for Bitcoin alone, the highest intensity since the beginning of the year, volumes that have not been recorded since October 2019.

The dominance of Bitcoin confirms the levels of recent days at 65%. Ethereum rises and conquers a few decimals reaching 8.6%. XRP instead returns again below 4%, the lowest level since the beginning of March which coincides with the lows of December 2017. In the last 30 days, 30% of the altcoins have outperformed the Bitcoin performance.

The increase of Bitcoin (BTC)

Bitcoin, with the increase of the last few hours, is back with prices at one step from $7,000. Area 6,800-7,000 dollars is the level of support that between November and January was the basis for the bullish redemption that characterized BTC until mid-February.

This is now a level that must be confirmed in the coming days. In cases of confirmations, the next level of resistance is the $8,300-8,500 area.

A decline below $5,500 would be negative, levels violated decisively yesterday and which were the former short-term resistance.

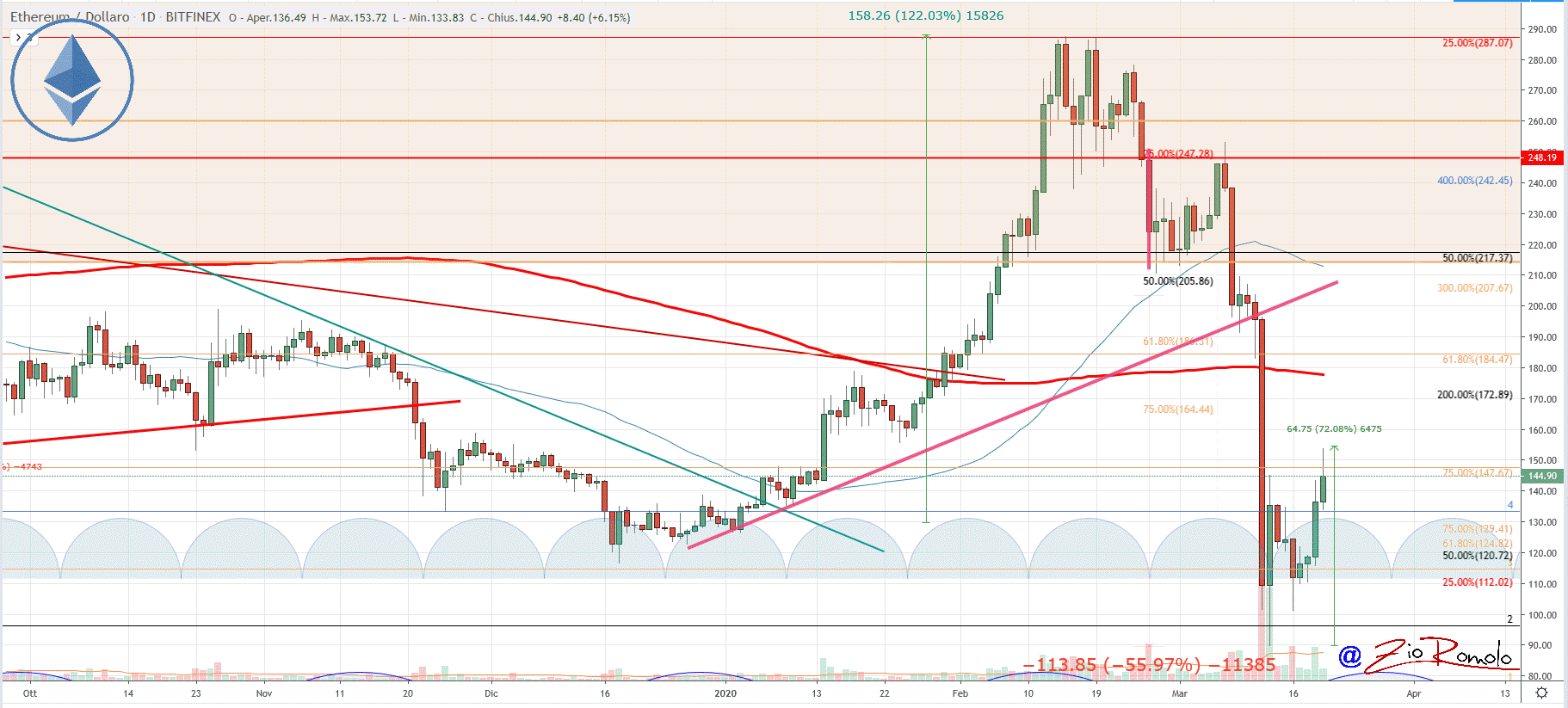

Ethereum (ETH)

Ethereum remains in line with Bitcoin’s bullish movement with an intensity that goes beyond 30% and allows it to recover more than 70% from last Friday’s lows.

For Ethereum, after returning above the former December lows at 125 dollars, it is now important to confirm the rise in the coming days and weekends. The recovery of $155-175 would indicate a first bullish signal in the medium term.

However, after the sharp fall from the mid-February highs and ending with the March 13th lows, it is necessary to contextualize this upward movement as a technical pullback in this bearish phase. ETH will have to confirm the $125 in the next few days and not go back below the $115 threshold.