The day is characterized by low trading volumes, decreasing for both Ethereum and Bitcoin, although for much of March, BTC was characterized by sustained volumes.

This condition highlights how there is a particular expectation also with regard to investors.

Volumes on Ethereum are also declining. In recent days, the average is around $150 million trades per day after the peaks recorded with the strong declines on March 12th and 13th.

In those two days, volumes of Ethereum on the major exchanges had risen to about $2 billion per day, which represent the highest trading volume peaks of the last year, since March 2019.

The third consecutive quarter was thus closed in red, with the month of March recording the most pronounced decline of the last year and a half.

Bitcoin marks -25% and Ethereum -40%, making March the most bearish month since November 2018.

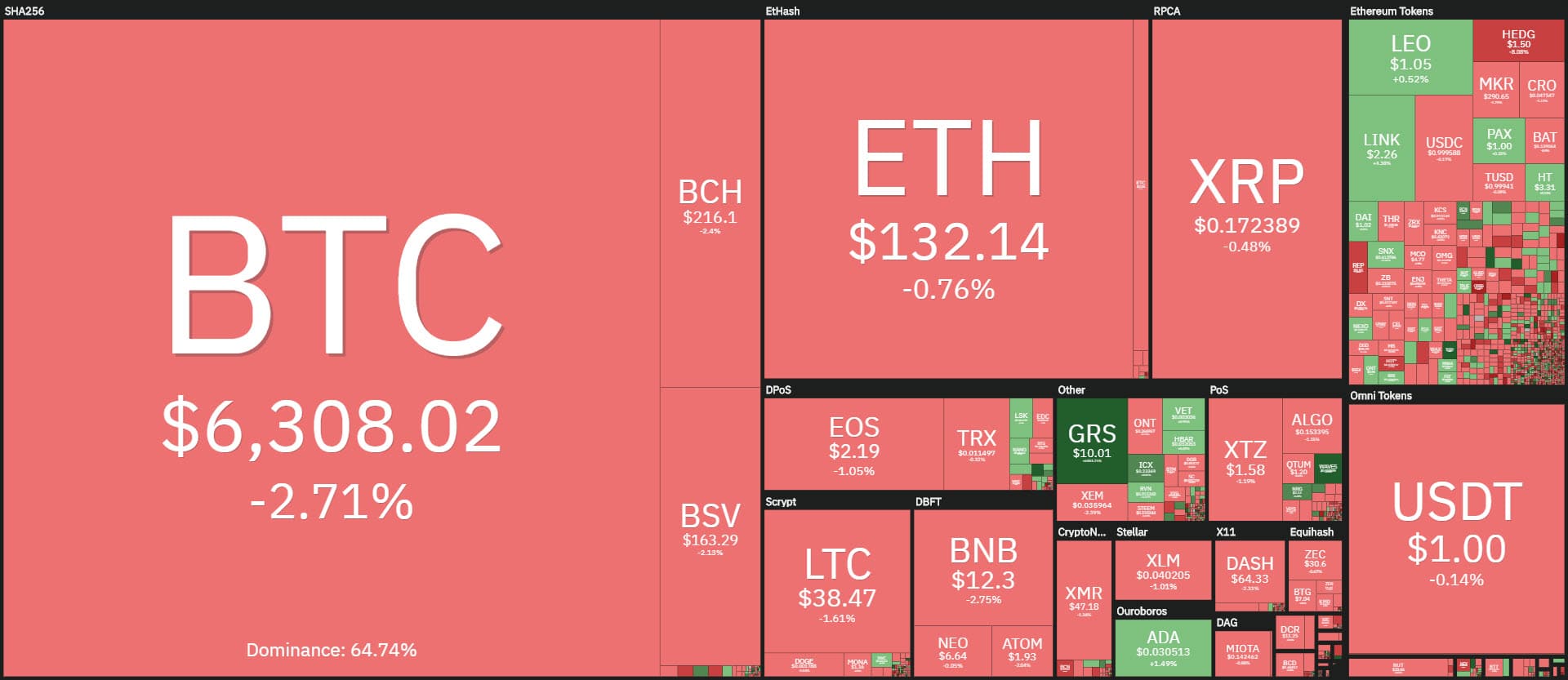

April, which statistically records the best performance, opens quietly with a balance between positive and negative signs, although among the big names, the red signs prevail.

Of the top 10, only Ethereum (ETH) and Ripple (XRP) recorded a positive sign in these early hours of the day with rises just above parity.

Only two altcoins stand out after the 40th position among the most capitalized, followed by the professionals of the sector: Waves (WAVES) and Icon (ICX), both climbing double-digit today, the only ones among the top 100, with a gain of almost 20% for both.

MakerDAO (MKR) follows from a distance with +6%.

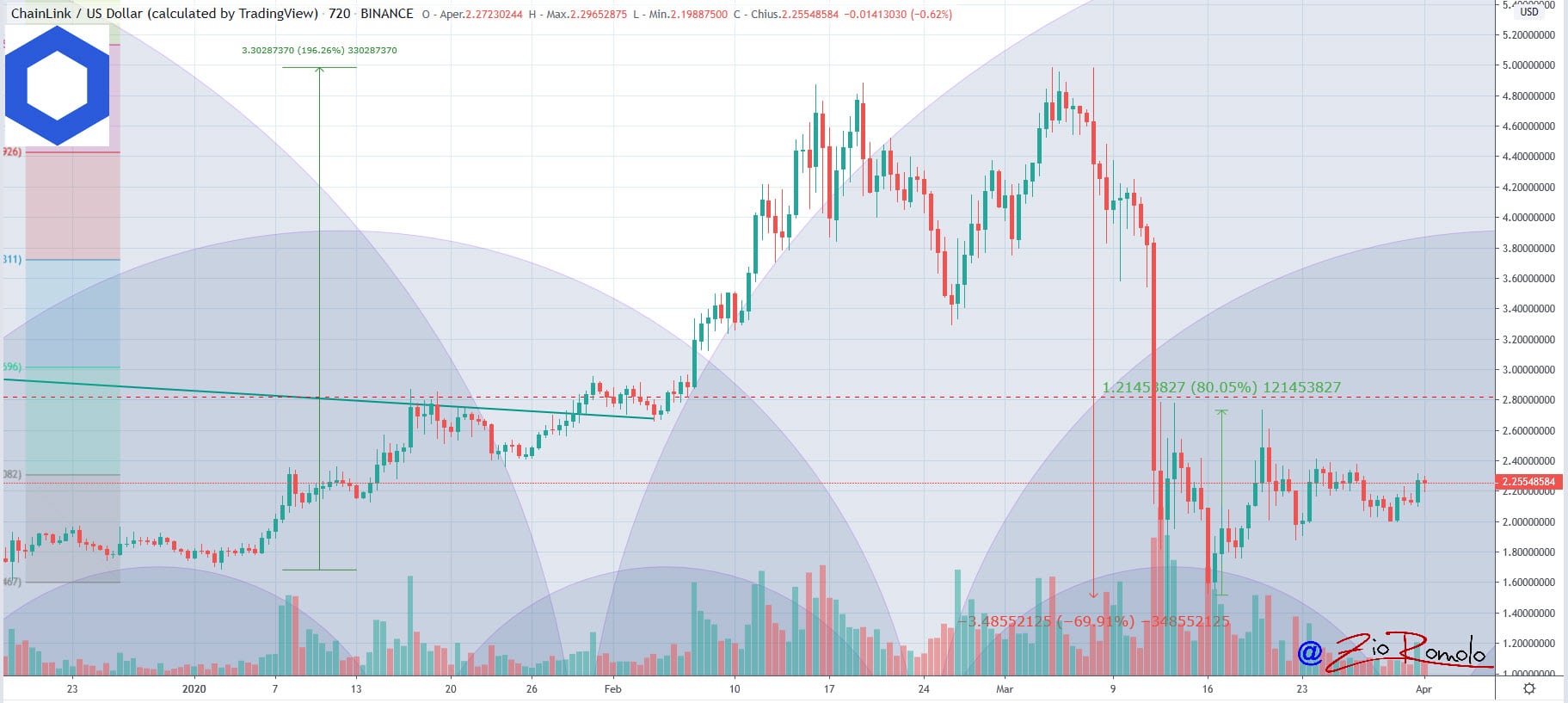

Same bullish intensity for Chainlink (LINK), which after days of suffering today gains 5% and conquers positions in the ranking, returning to 15th position. It should be remembered that a few days ago LINK had conquered for the first time the 11th position by following Tezos (XTZ).

Chainlink tries to move up after a downturn that since mid-March has put it among the worst altcoins. In 10 days, prices have seen it lose about 70% of its value.

After scoring the absolute historical highs at the beginning of March, the bearish trend began, which caused prices to collapse by 70%, placing LINK among the worst declines that have characterized the month.

With today’s rise, Chainlink is trying to regain the $2.30. It is necessary to recover the highs of the previous pullback over $2.80. Only above this level could Chainlink give a bullish signal in a short-term perspective.

Tezos, despite the difficulty and ups and downs of these days, which do not weigh on the technical position of the 10th in the ranking, today marks a -0.5%, just below par.

The market cap falls just below the threshold of 180 billion dollars. The dominance of Bitcoin returns to regress slightly, losing a fractional share and falling below 65%. Ethereum gains two decimal points since yesterday and rises to 8.2%. Ripple stable at 4.2%.

Bitcoin (BTC)

The technical foundation sees Bitcoin give more and more indications to be approaching the new 1-2 week cycle. It is a very important indication, as a descent below $5,800 would open technical hypotheses.

The first is that the current 1-2-week cycle will be set downwards, with a prevalence of a bearish trend. Alternatively, in the next few hours, the possibility that the current cycle has yet to end could open up.

At this stage, the swings are congested and BTC prices are moving in a range of $350, in stark contrast to the high daily volatility on a monthly and quarterly basis that remains at the highest levels in the last 6 years. This volatility collapse could be a pause before the next directional movement.

If prices take the upward path and exceed $6,800, a new weekly cycle would be confirmed, following the trend of the previous one, which seems to have closed up after three bi-weekly downward cycles.

Ethereum (ETH): low volumes

Ethereum continues to fluctuate around 130-135 dollars: its volatility is even more restricted. Technically nothing to add to what has already been said in recent days.

It is necessary for ETH to break the $140-145 as soon as possible, with extensions to $155, supported by volumes which have been falling sharply in recent days.

Otherwise, a return below last weekend’s lows, below $123-120, would highlight a trend for Ethereum that still remains in the hands of the bears.