Closing at $9,300, Bitcoin’s week ends positively and, when it comes to price analysis, this means that the 4-week downward series has ended.

This is a negative series that in the last 4 years has been recorded only twice, in summer 2016 and between October-November 2019. In the first case, the context was very similar to the current one, unlike in 2019, when a loss of about 27% was recorded.

In contrast, recent movements see the price of Bitcoin forced in a very limited range, recording deviations that do not go beyond 10%.

This has caused the volatility of Bitcoin to fall below 1.5% daily on a monthly basis. It’s the lowest level since March 2019, when it fell below 1.3%, and then, in the following weeks, exploded resulting in a rally that in just over two months saw Bitcoin prices gain about $10,000.

From $4,000, BTC touched the $14,000 at the end of June 2019. This is the highest level in the last two and a half years.

Returning to the current situation, for the second weekend in a row, there has been a slow trend, with low trading volumes. Putting together the trades on Saturday and Sunday, the sum does not exceed the volumes traded on Monday, July 6th, with amounts below $1.7 billion for Bitcoin.

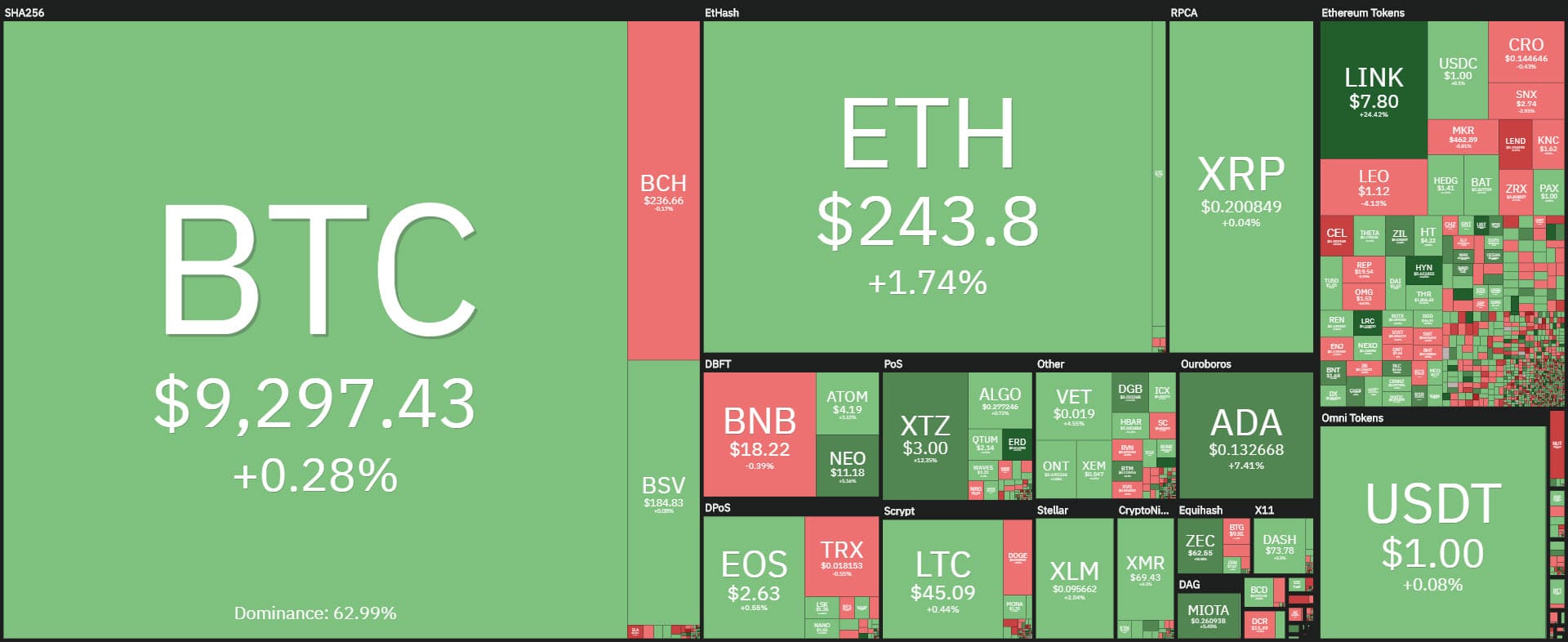

While Bitcoin continues to remain trapped in this low volatility, altcoins continue their upward trend.

In the last 24 hours, as well as over the weekend, Cardano (ADA) continues its remarkable performance, with a further leap this morning, reaching almost 6% and returning above 13 cents. Cardano regains the highs of the last two years, recorded last Wednesday, when for the first time since July 2018 the price has put its head back above 14 cents.

Cardano continues to climb to 6th place in the ranking of the most capitalized with over $3.4 billion, and starts a head-to-head with Bitcoin Satoshi Vision.

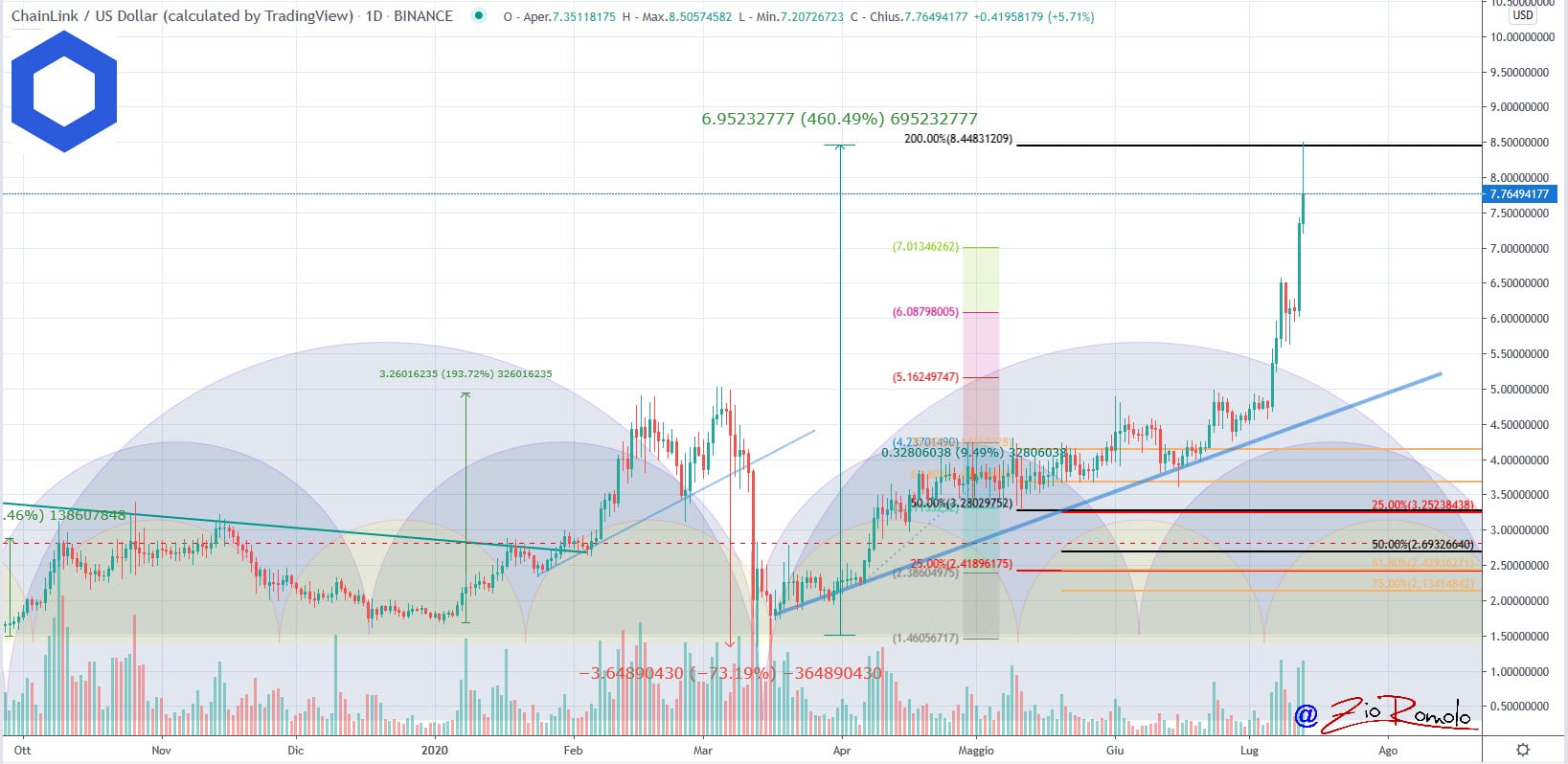

The other altcoin that is making a name for itself and one of the best rises of the day is Chainlink (LINK), which is up 30%. Chainlink takes 10th place in the standings, overtaking Crypto.com (CRO), just a step away from Binance Coin (BNB).

Chainlink registers new historical absolute highs with prices over $8.5, set during the night of this second week of July.

From the March lows, Chainlink sees the price fly by more than 500%, multiplying by 5 times its value in just 4 months. This is one of the best overall performances in the last 3 months.

The context continues to see the altcoins that report over $103 billion in capitalization. These are levels that have not been recorded since February, when they exceeded 113 billion that had not been recorded since July 2019.

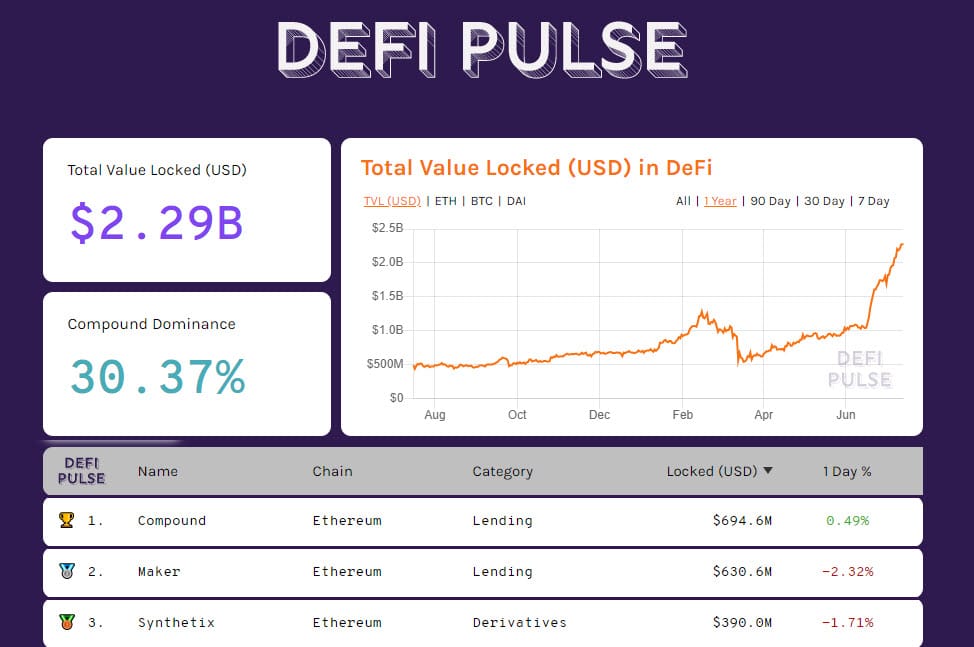

The tokens in the DeFi sector continue to rise. FlexaCoin (FXC) is doing very well, rising 22%. Bancor (BNT), Loopring (LRC) and Ren (REN) are up over 7%. On the other side, there is the collapse of Ampleforth (AMPL) which drops by 25%. 0x (0X) and Compound (COMP) also fell slightly, down 4% from yesterday’s levels.

TVL sets a new historical record, reaching 2.3 billion dollars.

Since last Monday’s levels, more than $400 million have been added, a volume that when compared to the locked total is similar to what was recorded as TVL in September 2019.

The volume that had been traded in several months was practically recorded in one week.

The lion’s share is still held by Compound, which together with Maker holds 60% of the dominance locked in collateral.

As far as the general market is concerned, it is the altcoins that make the market cap rise again to 275 billion dollars.

The dominance of Bitcoin remains just above 62%, the lowest levels since July 2019.

Ethereum does not benefit from this and neither does Ripple (XRP), remaining at last Friday’s levels just under 10% and 3.2% respectively.

This is a snapshot of what is happening, namely that it is the other altcoins that are supporting the current increase in the market cap, with the rises of Chainlink and Cardano in particular.

Cardano itself from last Monday’s levels gains over 35%, while Chainlink goes over 60%. Stellar (XLM) with +37% is among those that have achieved the highest increases on a weekly basis among the top 20 crypto assets in the ranking.

Trading volumes are down on a weekly basis, but today they are giving a first sign of an increase, compared to the very low volumes of the weekend.

Bitcoin (BTC) price analysis

The price of Bitcoin continues to fluctuate at the $9,300 threshold. This is the level where the battle is fought over option hedges among professional investors, who trade large volumes of option derivatives at this very level.

Hedges for possible declines are decreasing again, even though the defence between $8,700 and $8,900 remains solid. On the rise, the first level to exceed, taken as a reference for higher hedges for call positions, is $9,600 followed by $9,850.

Prices continue to remain caged within the $9,000-$9,500 range.

Ethereum (ETH)

Despite the low trading volumes, Ethereum manages to stay above 240 dollars, one step away from the highest peaks of the last 4 months, recorded at the beginning of June and equivalent to 254 dollars.

This is the first level of coverage on possible resistance breaches, to cover call options for a possible increase.

Defence positions clearly prevail on Ethereum over any downturns. The $215 area remains decisive, but the hedges also rise between $225 and $240.