Analyzing today the first 100 cryptocurrencies per market cap, the podium of the best of the day goes to Yearn.Finance (YFI), which has achieved a rise of more than 30%, benefiting from the listing in the basket of Binance.

The YFI token is among the new projects of DeFi. Launched at the end of July, Yearn finance immediately gained the support of operators. In less than a month the value of the YFI token has increased from $750 to over $7200, reflecting the DeFi frenzy that characterizes every new promising project, with increasingly attractive offers in the form of incentives and rewards to participants.

Meanwhile, the Fear & Greed index, which measures the morale of crypto operators from zero to one hundred, has risen to 84 points, the highest peak since June 2019 when it rose to 92 points, the absolute historical level.

This indication highlights the current phase that since mid-July is recording a new spring for the entire sector with generalized increases that, in addition to prices, are once again attracting the attention of both small and large investors.

It should be remembered that the month of July recorded new records in both spot and legal markets, as well as in derivatives and regulated exchanges such as that of the CME and BAKKT.

The trend does not stop in August either, statistically the period that usually records a decrease in trading.

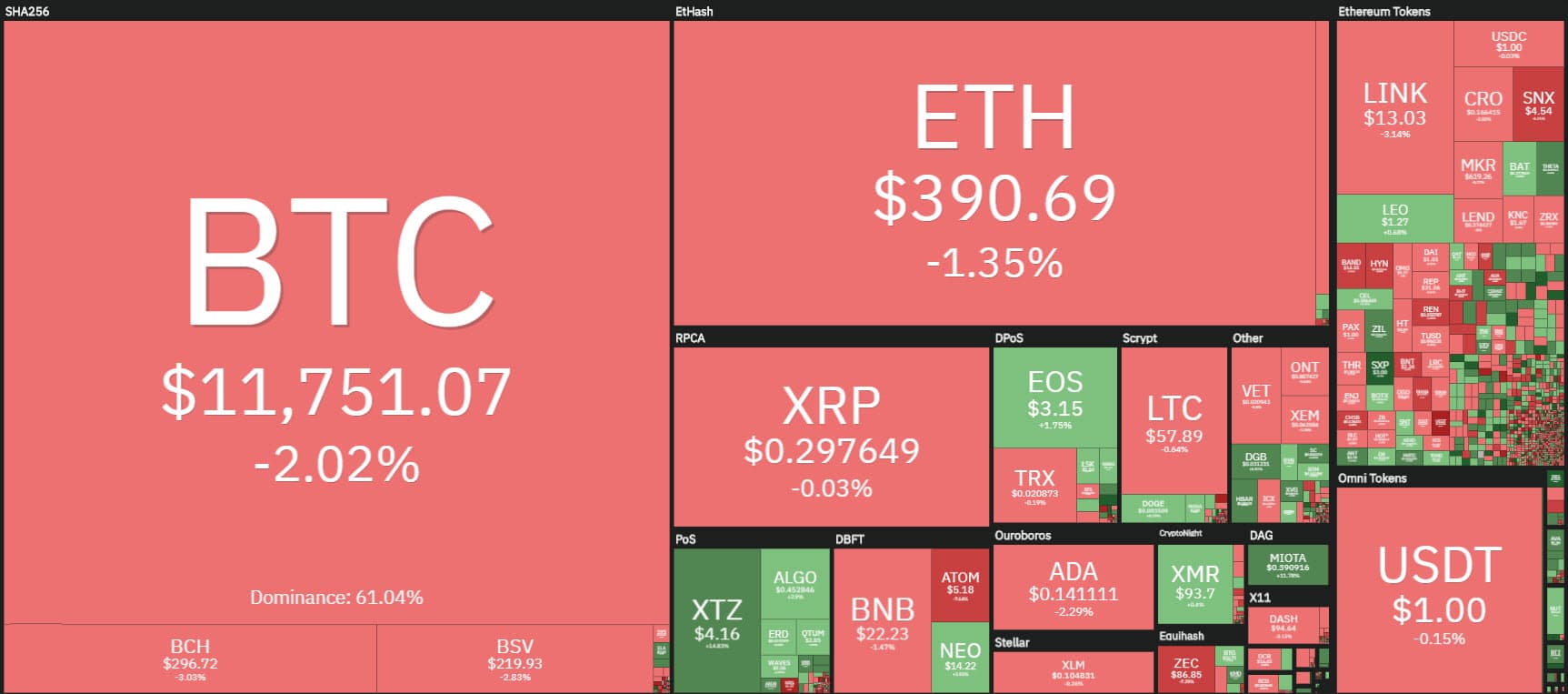

The first part of the second day of the week continues to show a prevalence of green, with more than 70% above parity.

A different picture if we narrow the analysis to the first 10 capitalized: in fact, only Ripple (XRP) is above parity with a hesitant +0.5% on a daily basis. Meanwhile, some Big names are experiencing losses: -0.8% of Litecoin (LTC) and -3% of Bitcoin Cash (BCH).

Tezos (XTZ) and Iota (MIOTA), on the other hand, are both up by more than 12%.

The total market cap remains above $360 billion with trading volumes remaining tonic with over $150 billion total traded in the last 24 hours.

Bitcoin, with over $3.1 billion, recorded the second highest peak day since the beginning of the month and the fifth since the beginning of July for volumes measured with the US currency rate (USD).

Bitcoin’s dominance is again close to 60%, the lowest low since the end of June 2019. Ethereum also drops to 12.17%, while XRP is recovering a fraction price, rising to 3.7%.

Bitcoin (BTC)

The Bull returns to the attack of the 12000, showing again that it does not have the support of purchasing volumes. A signal that, if repeated, indicates that operators prefer to wait for new purchases.

Otherwise, they might prefer to take short profits and wait to build a support base where to strengthen the recent increases.

Yesterday, professional derivatives traders increased their positions in defence of resistance between 12100 and 12600 dollars.

Downwards are increasing the Put positions to defend the 10500 dollars, followed by room until 8900. Prices in euros test the psychological threshold of 10000. With the European currency, the threshold to be monitored is €9500, former resistance now medium-term support.

Ethereum (ETH)

As in the past week, prices continue to fluctuate just over $390. Attempts to break the $400 psychological threshold so far have proved to be simple tests of a psychological level that is not proving particularly sensitive.

Professional traders prefer to monitor the $410 resistance, a level tested twice last week that has seen profit-taking prevail, pushing prices back to current levels.

Downwards, there is still plenty of room for dangerous speculative descents all the way down to $350-325.