There is only one positive sign among the first 15 capitalized, that of Chainlink (LINK) which, after four days of suffering, goes up again, reacting with a +5% from yesterday’s levels.

The prices of Chainlink, after piercing the $20 for the first time last Monday, have suffered a loss of 30% due to massive profit taking. This drop seems to have ended at the moment, although we will have to wait for a confirmation in the next few days.

With today’s climb, Chainlink is back in fifth place with more than $5.7 billion. Bitcoin Cash (BCH) is again at a distance of more than $300 million, losing 1.3% today.

For both Bitcoin and Ethereum, as well as most major altcoins, it is the third consecutive day downwards. A sequence that hasn’t been recorded since the end of June.

Total capitalization remains above $365 billion with volumes down in the last 24 hours (-20% since Tuesday). However, trading on Bitcoin remains strong, for the third consecutive day above $3 billion.

Bitcoin’s dominance has risen slightly to 59.5%, after having reached the minimum since June 2019. Unchanged for Ethereum (12.5%) and XRP (3.6%), stable at last week’s levels.

Bitcoin

Prices are trying to consolidate above $10,500. The operational indications remain unchanged from the levels indicated yesterday.

Upward, the break of 12,500 dollars is necessary, while downward, it is important to keep the 10,500 dollars or, in case of breakage, not to extend the decline below 10,000 dollars.

Ethereum

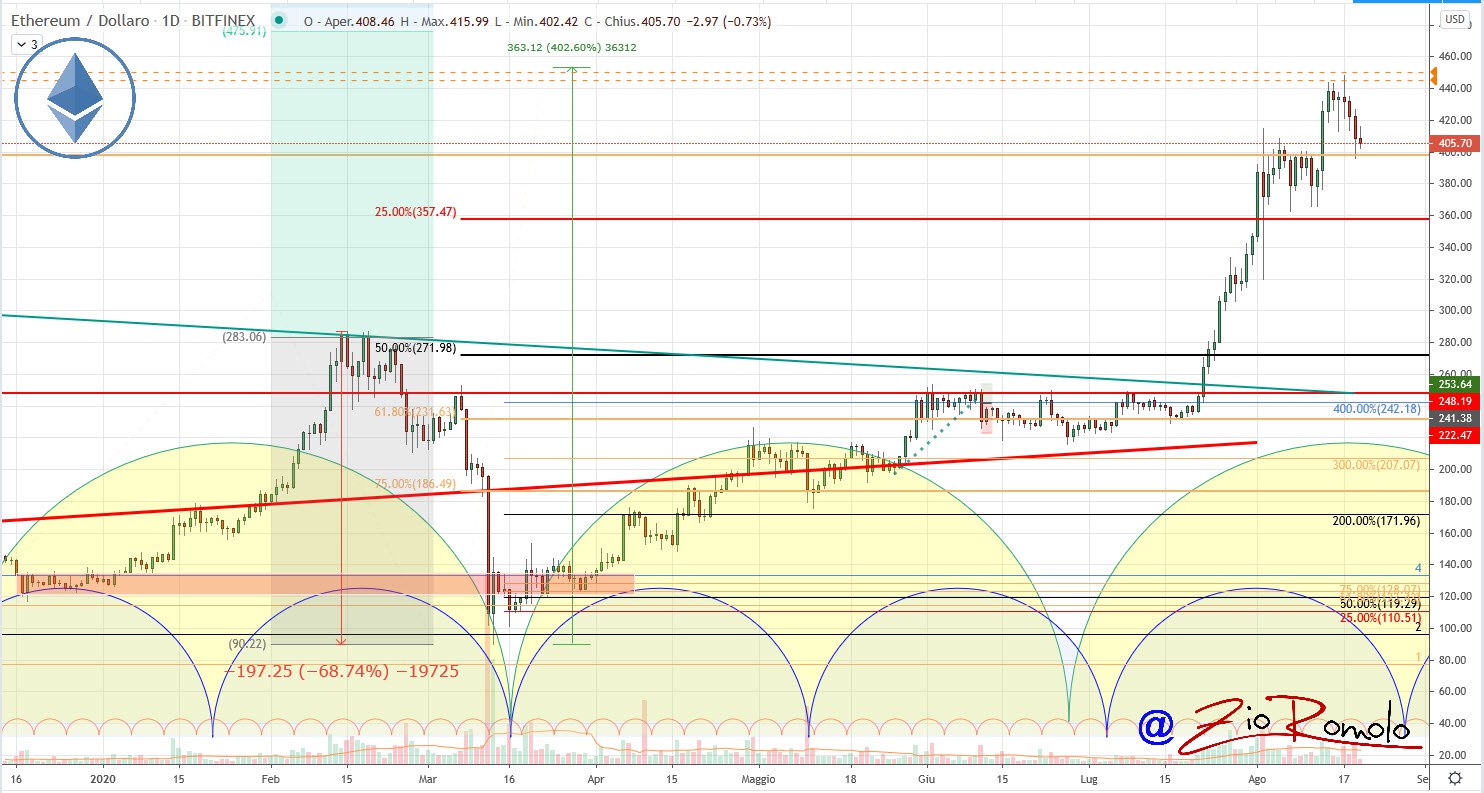

In these hours the prices of Ether are back again to test the crucial support of the $400, former resistance level. The tightness of this threshold will be a clear signal of strength.

On the contrary, stretches below $390 will have to stop in the $355 area in order not to compromise the bullish trend built in the last month that saw Ethereum prices double in just four weeks.