The week characterized by the launch of the Uniswap token is coming to an end with a positive sign.

Since the end of last weekend, the price of Bitcoin is up by 7%. The same gain for Ethereum, which until yesterday seemed to have fallen behind. In the last hours, especially since the end of yesterday, the prices of ETH have put their heads back above the 390 dollars that had not been seen since the beginning of September.

For Ethereum these are hectic days. In the last 24 hours, there have been significant volumes of activity, even though they are not the highest of the month, when it exchanged more than 3 billion in countervalue in dollars, with prices above 450 dollars.

Yesterday the volumes of Ethereum were close to those of Bitcoin, 1.2 billion dollars for ETH compared to 1.3 billion for Bitcoin, which yesterday experienced a drop in trades on its chain.

This was the result of a feverish day that saw the launch of the Uniswap token causing daily transactions to soar to 1.2 billion, a record that goes way above that of January 2018, when ICOs were in full speculative bubble.

As mentioned, this increase is due to the launch of the Uniswap token, the first decentralized exchange in the decentralized finance universe, which boosted trading thanks to the airdrop that was given to those who used the exchange before September 1st, either as a liquidity provider or for trading. These users received a gift of 400 UNI tokens which at the current price is equivalent to over $1,500. A fact that prompted many traders to cash in on this beautiful gift at the end of the summer and bring trading on the Ethereum network to an all-time high.

The gas fees also reached an all-time high at 650 Gwei.

It has been a lively week, opening the third weekend in September which promises to be very hot, more so than the previous ones which have seen trades focus on the second-largest blockchain, Ethereum, which has outperformed trades on the Bitcoin chain.

Crypto market, +110% for the Uniswap token

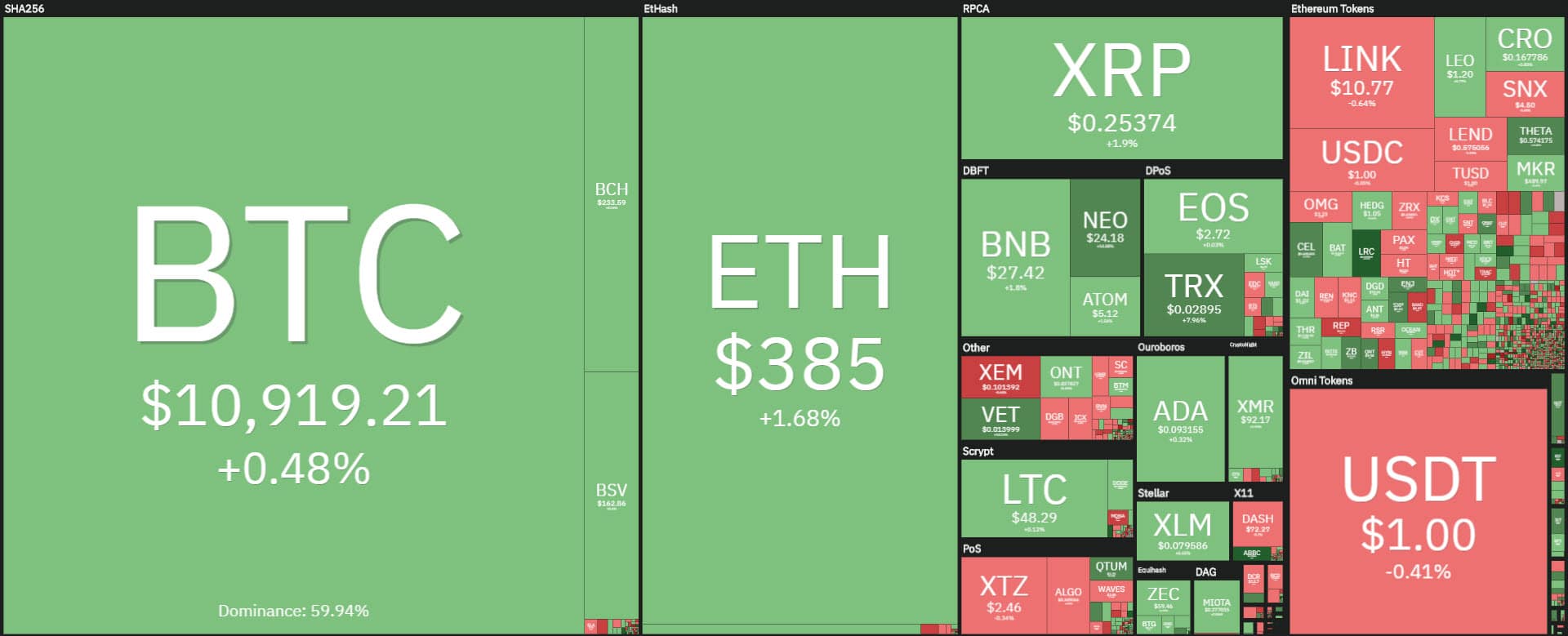

The day sees a prevalence of positive signs with more than 60% of cryptocurrencies in green.

Among the best, there is a triple-digit increase, that of the Uniswap (UNI) token, which, in less than 24 hours, conquers the 26th position in the ranking with about 876 million dollars of capitalization, with an increase that on a daily basis is more than 110%.

ABBC Coin (ABBC) follows at a distance with a respectable increase of +28%. Sushiswap (SUSHI), the fork of the Uniswap’s DEX, which after yesterday’s sharp decline, today is up more than 20%.

Contrary to the beginning of the week, today Hyperion (HYN) is down more than 20% for the second day in a row. This highlights how traders are taking profits on this token.

Today’s rises are benefiting the entire token ecosystem that revolves around DeFi.

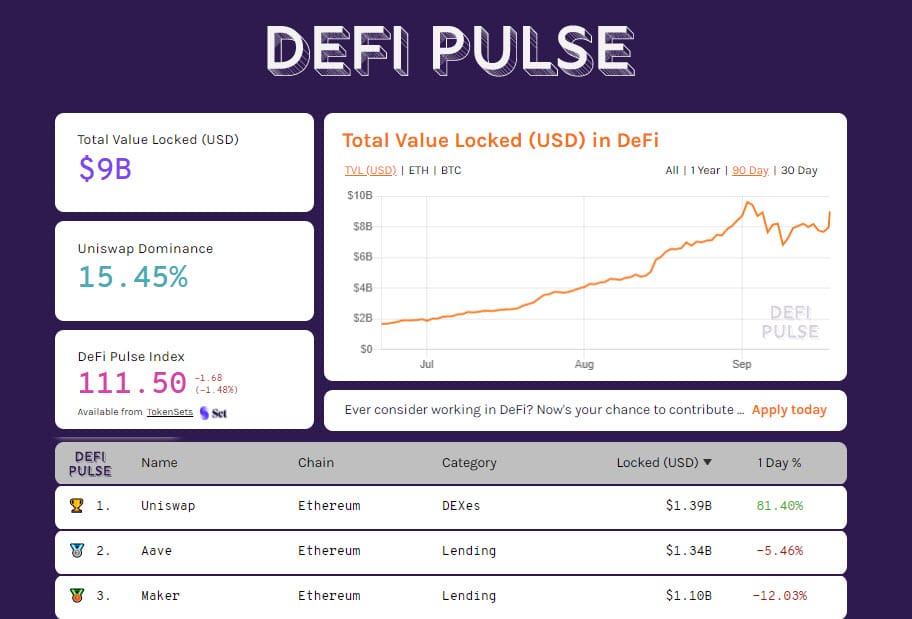

The TVL returns above 9 billion dollars. The sector is likely to be on the verge of attacking the all-time record of 9.6 billion dollars set on September 2nd.

Meanwhile, today there is a new record for the number of Ether locked on DeFi protocols, over 7.5 million units. An absolute historical record has also been set for the tokenized Bitcoin using the ERC20 standard, with over 107,000 pieces.

What occurred with Uniswap brings the DEX on the podium of the dApps with the most collateral locked, worth 1.4 billion dollars.

Uniswap is the first DEX to take the lead, followed by Aave and Maker with over 1 billion locked collateral. These numbers are important and indicative of how the sector is gaining strength again.

The market cap benefits from this, which now stands at over $355 billion, recovering $10 billion in the last 24 hours. These are the levels of the first days of September.

Bitcoin is falling slightly above 57% of market dominance. Ethereum is back to 12.5%, the highest levels in the last two weeks. Ripple instead is static at 3.2%.

Bitcoin (BTC)

Yesterday Bitcoin tried to exceed $11,000 again, but as happened on Wednesday, profit-taking prevails with the return below this threshold which is more psychological rather than technical.

A new increase on a weekly basis will be positive if on Sunday evening the closing above $11,000 is confirmed. It would be a sign of a strong reaction after the sinking suffered at the beginning of the month.

In the medium to long term for Bitcoin, it is necessary to protect the $10,500, where in the last 24 hours the positions have increased in order to protect possible decreases. Below $10,500 there is the possibility to dive back under $10,000, but at the moment there are no dangerous signals on a technical basis.

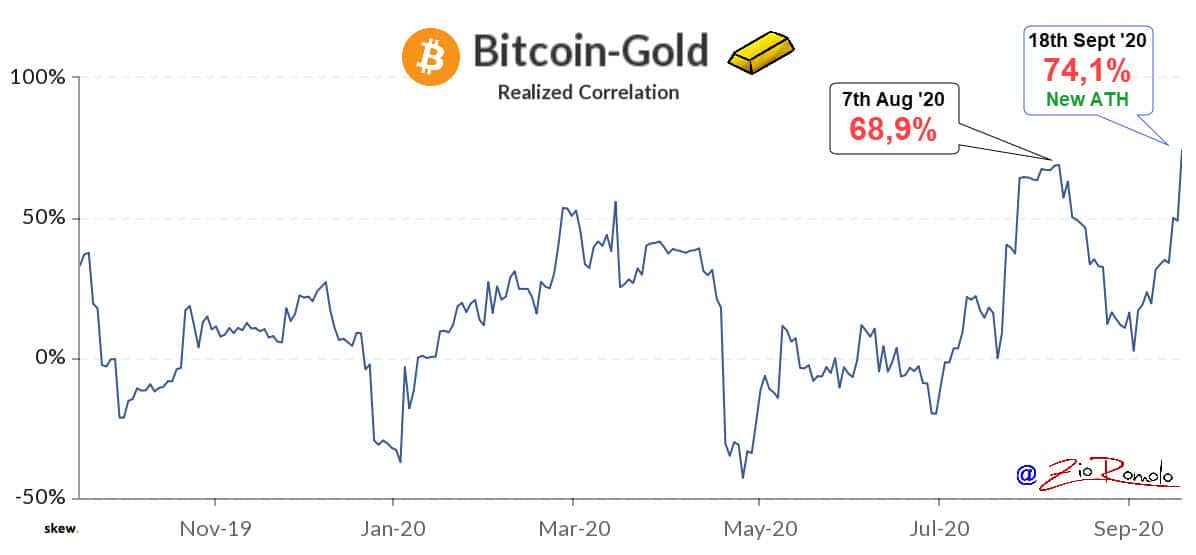

Despite the initial sinking, September shows a correlation between gold and bitcoin at an all-time high of 74%, exceeding the previous record at the beginning of August, when it was close to 70%.

It is a decidedly brilliant moment for Bitcoin that confirms the narrative of digital gold.

Ethereum (ETH)

Despite the euphoria surrounding what is happening in DeFi, the price of Ethereum is struggling to exceed the threshold of 390 dollars, and the psychological threshold of 400 dollars.

Any extension above $405 would open up space to test area $415-420, the highest level of derivatives options coverage on Ethereum.

For ETH, it is necessary not to go below 355 dollars, a crucial level since the beginning of last August and that has seen prices consolidate over the last week, pushing again during these hours above the relative highs of September 5th. The $380-390 is a watershed threshold.

It will also be important for ETH to understand what the weekly closing on Sunday evening will be like, whether above or below $380.