In recent weeks, much of the attention of the crypto world has focused on the topic of bitcoin ETFs, also largely thanks to the introduction of Bakkt and its own platform that closely resembles these financial tools.

However, if BTC seems to be a winner in finance, will its use as a method of payment have the same fate?

The possible competition between LTC and BTC is a fight between close relatives.

Recently, Charlie Lee, the creator of Litecoin, confirmed that his idea had been closely inspired by his older brother, Bobby Lee, and explained that, according to him, BTC, together with ETH and his creation are the indicators of the general trend of the crypto market.

From a technological point of view, the fundamental distinction is the different cryptographic algorithms they use. Bitcoin uses the SHA-256 algorithm, while Litecoin uses a relatively new algorithm, known as Scrypt.

This difference has a direct consequence on the process of extracting new coins as well as on the extraction time: 2.5 minutes for LTC against the 10 minutes for BTC.

At the same time, the introduction of upgrade 0.17 will drastically reduce transaction costs.

Lightning Network wants to improve BTC’s scalability, but it is a new structure, which need to be built almost from scratch, with a minimum capacity that can not break through the ceiling of one million dollars (currently just over 700 thousand dollars), with great potential, but all to be implemented.

Lightning Network will be the ultimate decentralized exchange. Users that are running LN on both BTC and LTC can advertise an exchange price and act as a maker earning a spread. Other users can act as a taker and atomically swap LTC/BTC with the maker node via lightning. ⚡????????

— Charlie Lee [LTC⚡] (@SatoshiLite) July 11, 2018

Even now, the number of LTC transactions is much lower than BTC. To be precise, the number of bitcoin transactions in 24 hours is about 260 thousand, while Litecoin transactions are 24 thousand. Moreover, the Litecoin market is much thinner than bitcoin’s, 36.43 times less than the digital gold.

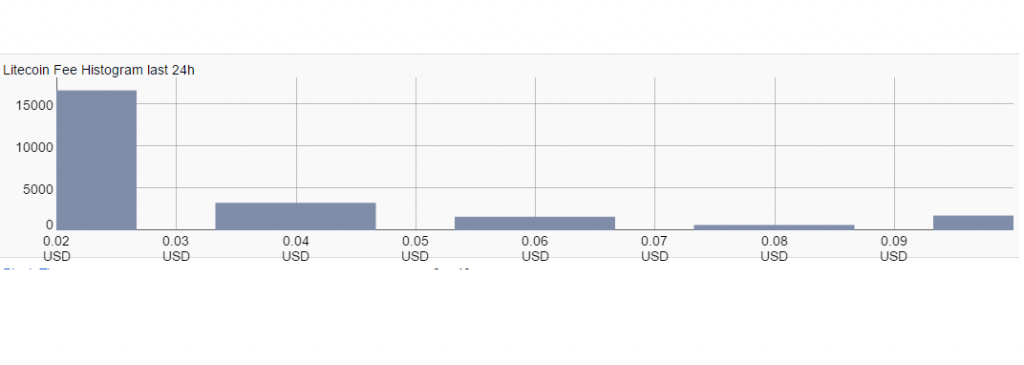

But, without yet implementing the new software, Litecoin has a very low transaction commission cost:

The cost of an average Litecoin transaction is about one-tenth of the equivalent value for Bitcoin, and the difference will increase.

The cost of an average Litecoin transaction is about one-tenth of the equivalent value for Bitcoin, and the difference will increase.

Unfortunately, the concentration of Litecoin is much higher than that of Bitcoin.

In fact, if we consider the quantities owned by the largest wallets, we have:

Litecoin

The first 10 wallets have 13.97%.

The first 100 wallets have 44.53%.

the first 1000 wallets have 62.50%.

Bitcoin

The first 10 wallets have 5.38%.

The first 100 wallets have 18.95%.

The first 1000 wallets have 35.86%.

This means that Litecoin’s owners are much more centralized and therefore more subject to possible price fluctuations if some whale decides to sell.

It must be said that the owners of LTC seem very interested in a long-term possession waiting for the network to grow and develop further.

Every day there is news about the use of Litecoin as a payment tool, for example, Litecoin has been recently implemented in the Marks Jewellers chain, or just a few days ago Wirex announced its prepaid card which will also be linked to a Litecoin wallet.