There are just 4 types of coins that are loved by institutional investors.

Big money is ready to buy up crypto. It’s thirsty. It’s ready — or at least getting ready.

To illustrate my point: Coinbase, the largest bitcoin exchange in the U.S., recently held a press briefing where its COO Asiff Hirji said:

“Coinbase will soon be capable of offering blockchain-based securities, under the oversight of the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).”

Coinbase is showing us where they — and millions of their customers — are heading in the crypto sphere. By acquiring Keystone Capital, a financial services firm, they sped up the process of registering as a fully regulated broker-dealer. This can only mean one thing: They are preparing to wine and dine the big players.

They are getting ready for the tidal wave of money about to pour in from pension funds, hedge funds, and other types of institutional investors.

The Wish List of an Institutional Investor

There are over 6000 crypto assets — and growing. An institutional investor will have a tremendous, if not impossible, time of going through them all and deciding. We would too. Therefore instead of focusing on specific coins, we’ll focus on the types of coins institutional investors will be looking for. Myriad cryptocurrencies will fall into multiple categories, but often a coin will fall into one category more than another. Here are the categories which institutional investors may love:

- Store-of-value.

A store-of-value coin is one which is not necessarily used as much as a currency so much as a place to park your wealth. Think of gold, it used to be used as a currency but now is used to store value as a hedge against recessions and other economic turmoil.

Coins which are stores of value would be attractive to big money such as pension funds, hedge funds, and other institutional investors who are looking to diversify their portfolio. They would be looking for coins that are established and therefore lower in volatility — at least when compared to fresh-off-the-press coins.

- STO: Security Token Offering.

Unlike ICO’s — which try their hardest to bypass laws and regulations — STO’s embrace government regulations. Specifically, STO’s are focusing on a SEC guideline which has been around for almost a century. First, they need to cut through some red tape: “company eligibility requirements, bad actor disqualification provisions, disclosure,” and others — but the benefit is worth the headache.

When an STO follows the SEC guidelines, they gain trust and transparency — two essentials which are hard to find in myriad ICOs. These two essentials thus give the possibility of opening up the crypto world to institutional investors and mass adoption.

Big money isn’t one person, it’s a large group, a group that is responsible and accountable to thousands, even hundreds of thousands of people (think pension funds). This responsibility means that they need rules to play by. Rules that they can fall back on if investments go belly up. That’s the main reason institutional investors haven’t entered crypto. They couldn’t. They legally couldn’t. No rules. If things went south, then they would be on the hook.

An STO, however, is playing by the rules. This brings comfort to institutional investors.

- Utility Tokens.

These types of coins, or tokens as some call them, offer a specific purpose. Perhaps they store smart contracts (think Ethereum ERC20 or ERC 721). Or perhaps they have specific functions (Steemit uses Steem to curate content). Whatever it is they do — they do something.

Institutional investors could be keen on putting a bit of money into this area. However as with all risk-reward calculations — the firm behind the utility token would need to have a long and proven track record of their coin being used as a utility — not as a security. Currently, this is not the case with most utility tokens.

Investing in utility tokens that aren’t legally compliant is one of the mistakes cryptocurrency investors make, according to CryptoManiaks. Remember: even if a utility token tries to remain a utility — if they slip up just once — they and their investors risk the wrath of the SEC. Institutional investors don’t want the SEC to snatch up any profits, or worse, invested funds they may have.

- Cryptocurrencies.

The category that started it all. The dream behind cryptocurrencies is to use them as their name implies — as currencies. Thus they should have the characteristics of a currency: fungible, divisible, stable, etc.

Here we run into a bit of a bog. Will institutional investors pick up cryptocurrencies? After all, if one of the hallmarks of a currency is its stability (you don’t want to buy a beer for X one day and Z the next day) then what is the point of buying it as an investment?

Nevertheless, currencies do rise and fall in value. Institutional investors may be attracted to this.

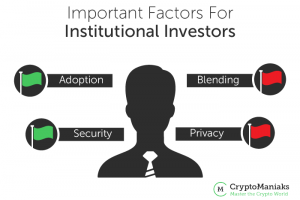

Factors Institutional Investors Will consider Before Buying In

Before investing in a crypto asset, institutional investors will also look at other aspects.

Green Light Factors

Adoption. Which cryptocurrencies are most massively adopted? Mass adoption leads to more stability, trust, and other qualities institutional investors look for.

Security. This is a big point that applies to all the above categories, in fact. How susceptible is the coin to hacks, scams, and other defrauding endeavors? For instance, if a coin’s blockchain is more prone to a 51% attack — and thus its supply or value can be tampered with — then once again institutional investors will stay away. Bitcoin is a major green light because of how secure it is (massive mining network preventing 51% attack). Whereas one of its scammy offshoots — Bitcoin Diamond for example — very much lacks this type of security.

Red Flag Factors

Blending. Many cryptocurrencies are such a blend of categories that it’s difficult to pinpoint what that coin is. Some people might think it’s a good thing. Others will say the opposite. Remember, an institutional investor doesn’t want to take on too much risk. If there’s a chance that the SEC mislabels or shuts down a coin, that’s a no go.

Privacy. Some cryptocurrencies bill themselves as focused on privacy (Monero, Zcash, etc.). But will institutional investors buy these? After all, what if some terrorist uses a privacy focused crypto to do something horrendous? And your retirement account holds some of that crypto? This could be bad press. Privacy is an exciting thing for cryptocurrencies focused on being currencies for the masses — but for institutional investors, it’s much lower on the list.

The Game is Changing

The name of the game is changing. Coinbase is only one of the many exchanges and companies preparing for the inevitable influx of big money. Institutional investors from countries around the world are waiting on regulation from their governments — and its coming, slowly but surely it’s coming.