Okex exchange in the bull’s eye: uncontrolled rumours and the risk of heavy unmanageable losses.

In the end (assuming this can be said), the company was forced to execute future contracts by force.

After all, futures can be an opportunity to earn money, but caution is needed.

Okex operates an internal futures market on the main cryptocurrencies and, among these, the most active is obviously that of bitcoin.

The problem arose in recent days when BTC prices have fallen well below $8,000, just before the expiration of the 31 July futures contracts.

Evidently, someone had exaggerated, if one may say so, on the Long contracts, (Coinmarketcap data):

Losses on long contracts usually cover gains on short contracts and vice versa.

In this case, however, someone has signed a huge long contract, for more than 460 million dollars, the execution of which would almost certainly not have been successful anyway.

In such cases, there is – or should be – a lifebelt.

In fact, corporate insurance is taking over to cover this type of loss but, in the specific case we are talking about, the value of the cover was ridiculous compared to the value of the contract not executed: 10 million dollars.

Since these are open futures in Okex’s domestic market, the social impact of such an operation could have been devastating for the exchange.

All this has caused a riot of extremely negative assumptions in recent days, to the point that the company was now forced to enforce futures contracts (Clawback) at 17:00 in Hong Kong (11:00 in Europe), but with some corrections in favour of holders with short contracts:

- First of all, it injected 2,500 BTC into the insurance fund to compensate the short contract holders;

- It then paid particular attention to the contracts that were being wound up, shifting the execution of malicious contracts from automatic to manual;

- Lastly, it announced new risk management practices for its financial activities.

How great was the risk for market participants? The guarantees to cover the forced execution of contracts on the market are 10% for those executed with leverage 10 while it is 20% for contracts executed with leverage 20: all this regardless of the size of the contract and the number of open positions.

The market could have been shattered by paying only a tenth of the contract value, which we know to be completely inadequate in a volatile market such as that of cryptocurrencies.

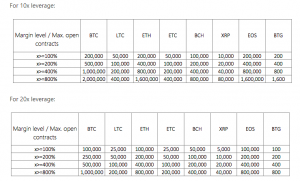

After this disastrous forced execution, Okex was forced to review its risk management practices, also introducing increasing guarantees as exposures and open contracts grew:

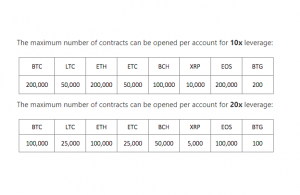

To this, a further restriction on the number of contracts that can be entered into has been added, which varies depending on whether the contract was 10X or 20X.

In short, the exchange has fared well, even though it has revealed its enormous and intrinsic weakness in terms of risk management.

It is clear that risk management policies were not sufficient.

The introduction of a size limit seems more than necessary and, perhaps, will not even be sufficient.

Since at this point Okex has to manage operations of pure financial speculation, without any link to the real economy.

There is no real guarantee of performance of the contracts, in the same way as, in games, there is no guarantee of performance of a natural obligation.

Moreover, given the figures involved, it is not impossible that short contract holders have played down on other exchanges, to increase their potential gain and put further pressure on Okex.