Bitcoin puts the turbo and with a solo race returns above $12000, heading for the annual highs. As repeatedly anticipated on these pages, the breaking of the cap placed at 11,600 USD, which for two weeks has resisted any attempt to break, has exploded the purchases of both new positions and open positions downwards.

A mix that in a few hours raised the price by over 700 points, reaching over $12,300.

With a rise of over 3.5%, Bitcoin’s daily performance is the best rise among the big names. TRON (TRX) manages to keep up with a climb just over 3%. Only tokens from the decentralized finance ecosystem do better.

Among the top 100 capitalized, the best of the day is Ampleforth (AMPL) with a jump of over 8%, followed by Waves and Decentraland (MANA) rising more than 6% from yesterday morning’s levels.

Bitcoin’s excellent strength emerges when comparing the weekly performance of the top ten. From last Wednesday’s levels, only Bitcoin scores a 7% gain, while all other altcoins are in the red.

Among the top 50, only Stellar (XLM) can do better with a weekly gain of almost 10%.

The rise of the prices of Bitcoin causes the capitalization of the queen of the cryptocurrencies to rise over $225 billion, bringing the capitalization of the entire sector to over $372 billion, recovering the levels of the end of August.

Bitcoin strengthened its market share above 60%, to the detriment of Ethereum which fell below 12% and XRP which fell again to 3%, the lowest annual levels of early July.

The conversion of bitcoin into ERC20 tokens continues, rising to over 163,000 BTC, contributing to the new record of the total value locked in DeFi projects.

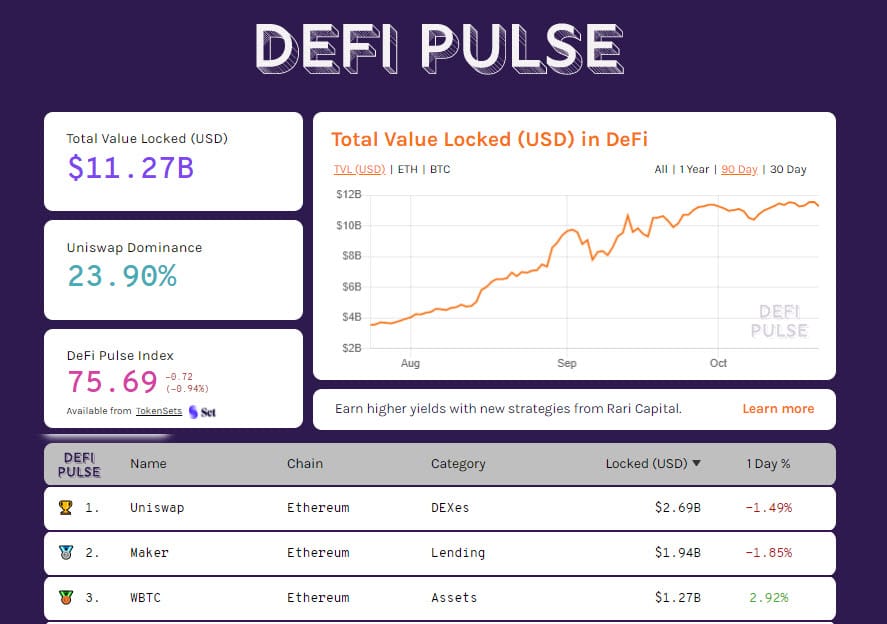

Yesterday, for the first time, the total collateral value exceeded $11.5 billion.

Uniswap remains the leader with $2.7 billion, followed by Maker and WBTC. Movements in the last few hours have increased trading volume on DEXs to over $430 million, an increase of 40% on a daily basis.

Bitcoin (BTC) is again above $12,000

For the eleventh consecutive day, the prices of Bitcoin close the day above 11,000 USD. Another sign of strength that brings back the confidence of the operators.

The Fear and Greed index rises above 60 points, a level abandoned at the beginning of September.

The current increase confirms the strategies put in place by professional traders who had started to change hedging strategies in recent weeks.

With the breaking of the 11,600 USD, the defences of the bears are triggered, raising the white flag. In contrast to a few weeks ago, the strength of the downside Put covers reinforces the ongoing bullish movement. Only a return below 10,400-10,150 would call the trend into question.

An increase above 12,400 USD would lead to a further lengthening of the trend.

Ethereum (ETH)

Price congestion continues, with prices unable to surpass the 390 USD mark, a level that has turned down all attempts to climb since mid-September.

Even during these hours of euphoria on Bitcoin, the prices of Ethereum remain frozen with fluctuations above and below 380 USD, bringing the daily volatility down to the lowest levels since July.

The probability of seeing a strong directional movement increases when prices decide to exit the side channel. Above 390-395 USD upwards; 325 USD downwards coinciding with the bullish trendline supporting the upward trend since the mid-March lows.