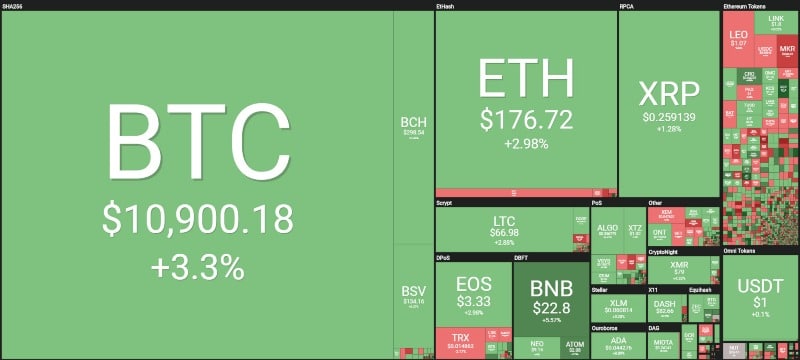

Today, the price of bitcoin rises again, with a gain of 3%, now just a step away from $11,000, a positive event for the beginning of the weekend.

Friday is about to end positively for the sector and in particular for the first in the ranking. Scrolling through the CoinMarketCap list, there are only two negative signs among the top 20, with decreases of more than 2% for both. These are Leo token (LEO) and TRON (TRX). The rest, driven by the new rise in the price of bitcoin, are in positive territory.

Bitcoin refreshes its dominance record rising to 71.5%, levels it has not recorded since the first quarter of 2017.

Bitcoin’s rise takes place today, September 6th, when Bakkt’s customers have the opportunity to transfer their funds to start buying and selling futures that will be launched on September 23rd.

This is likely to be reflected in the price of bitcoin and adds to the engagement of distinguished exponents, such as Jack Dorsey of Twitter, who referred to bitcoin as the cryptocurrency of the Internet. Apple has also recently stated that it is keeping a close eye on the cryptocurrency sector.

The launch of Bakkt’s futures in addition to these statements could be catalysing factors for the crypto industry and in particular for bitcoin.

Only Binance Coin outperforms bitcoin in the top 20 and returns to rise with a 4% increase. Also Monero, with a 4% gain, shows to be the only crypto that can keep up with bitcoin in this last month. Despite the concerted rise of the major cryptocurrencies and the first five, the others continue to fall in terms of dominance to the lowest levels of the last two years.

Volumes remain low, just over 55 billion traded in the last 24 hours, far from the 70 billion touched last week during the bearish phase.

The market cap continues to rise, approaching $275 billion.

Crypto market: the weekly balance

From a weekly point of view, bitcoin, together with Monero, and Ethereum Classic are the only ones that manage to achieve a double-digit rise. Among the three on a weekly basis, Monero rises by 16%, and Bitcoin does not stay behind, rising by 13%.

Today Ethereum rises by 3%, a percentage that allows it to close the week positively with the same percentile gain. Ripple rises by 1% and this allows it to close the weekly balance just above parity.

Bitcoin (BTC)

Bitcoin shows that last week’s downturn was a pretext to further consolidate the 9,500 area, however, not all bearish fears have yet been dispelled.

It is necessary for bitcoin, preferably over the weekend, to extend the rise beyond the $11,000 area that would allow a move, if supported by volumes, to $11,500 where the bearish trendline of the current downward triangle passes, a condition that would invalidate the technical figure, giving further bullish signals.

Ethereum (ETH)

Ethereum continues to suffer in a lateral phase with oscillations around the minimums of the period. Unlike bitcoin, ethereum is still in a consolidated bearish phase.

It is necessary for Ethereum, preferably over the weekend, to go and push over 185 dollars, in such case, it would open spaces towards the 200 dollars, a decisive area, both from the fundamental and technical point of view.