With a sprint of pride, although limiting the climb, Bitcoin marks a rise going to touch the $9,500, a level that had not recorded since June 24th.

The current trend remains in a context of laterality, with a volatility that continues to be below 1.5%, lowest levels since April 2019.

A general recovery that is also causing trading volumes to increase again, which in the last 24 hours have recorded more than 75 billion dollars, with Bitcoin rising again, recording the second highest peak of the last 7 days with about 1.7 billion traded volume in dollars.

What is characteristic of these movements is a possible start of an altseason.

Precisely in these last few hours, altcoins have recorded important increases, sometimes double-digit.

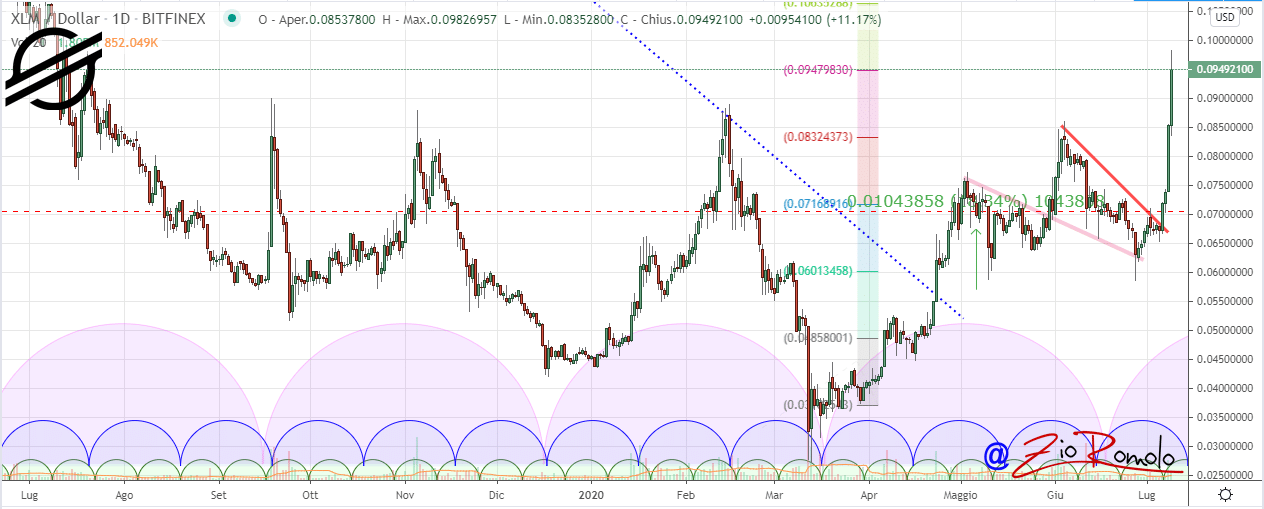

Today Stellar (XLM) flies 20%, taking advantage of the bullish cue initiated yesterday by Ripple (XRP), which today remains behind and gains only 1.5%. Stellar, on the other hand, puts the turbo and is one step closer to 10 cents, levels abandoned a year ago, in July 2019.

Today more than 75% of cryptocurrencies are in positive territory. Scrolling through the list of the major 20 capitalized there are only two red signs, Cardano (ADA) -6%, which reports profit-taking following the great performance of the last few days. Cardano has reached 14 cents, highest levels since August 2018.

On a weekly basis, Cardano and Stellar are the best, with an increase of over 30%.

The other negative sign among the top 20 is Tezos (XTZ) which drops by 1.5%.

Best of the day is Holo (HOT) which goes up by more than 35%.

In the DeFi sector, the TVL (Total Value Locked) continues to soar to over 2.150 billion, a run that seems to know no rest.

Compound maintains over 31% of the market share, while Maker is one step away from 30%. The first two together hold more than 60% of the tokens locked as collateral.

DeFi-related tokens continue to score double-digit increases, such as Synthetix (SNX) and Flexacoin (FXC), which are up more than 10%.

On the opposite side, the declines are contained. In addition to Cardano, there is Theta (THETA) which loses about 4%.

The total market cap rises above $275 billion, the highest levels in the last 5 months, levels at the beginning of June. Thanks to most of the altcoins that indeed rise above 100 billion of total capitalization and revisit the levels at the end of February 2019.

In terms of dominance, Bitcoin continues to decline and lose market share, despite today’s rise. Ethereum benefits from this, returning to 10%, already tested at the end of June. The strong increases of XRP bring its dominance back to 3.3%, which was not recorded since the beginning of June.

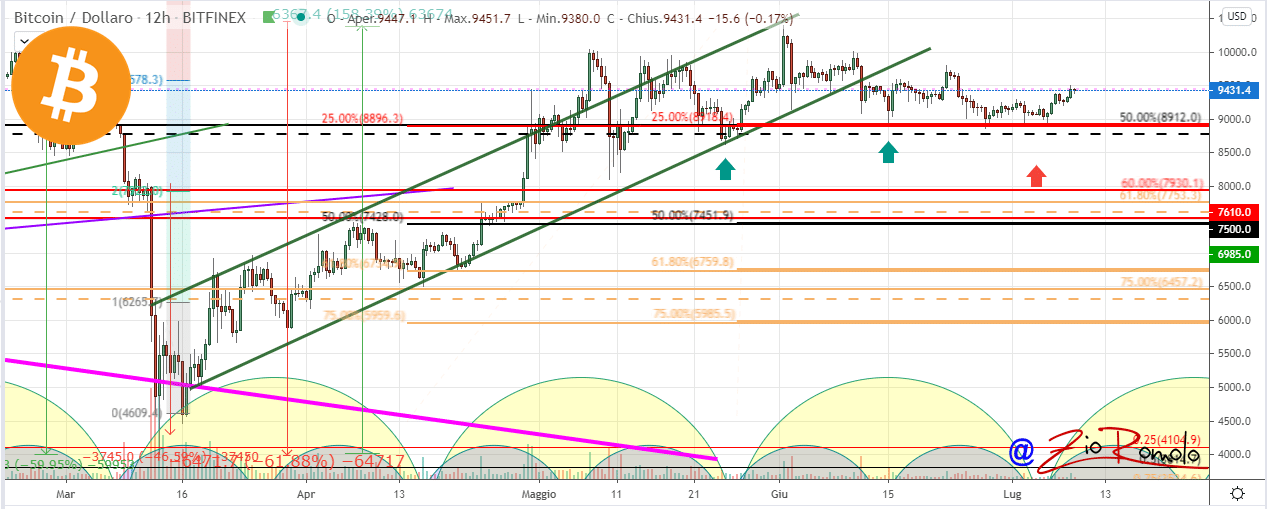

Bitcoin (BTC) on the rise

Bitcoin reaches the $9,500, up from Sunday’s lows by over 7%.

This doesn’t change the medium to long term picture except for the option hedges that are rising and repositioning, increasing the total volume for the $8,950-8,650 put positions.

By contrast, call positions are decreasing, falling dramatically below $10,000, preferring to protect the $9,600 resistance. This is the resistance to be broken down in the event of an increase that would lead to a new repositioning and most likely also to a new upward hedging strategy.

In fact, this upward movement of the last 48 hours means that it is necessary to analyze how to protect against the next strong directional movement due to the low volatility.

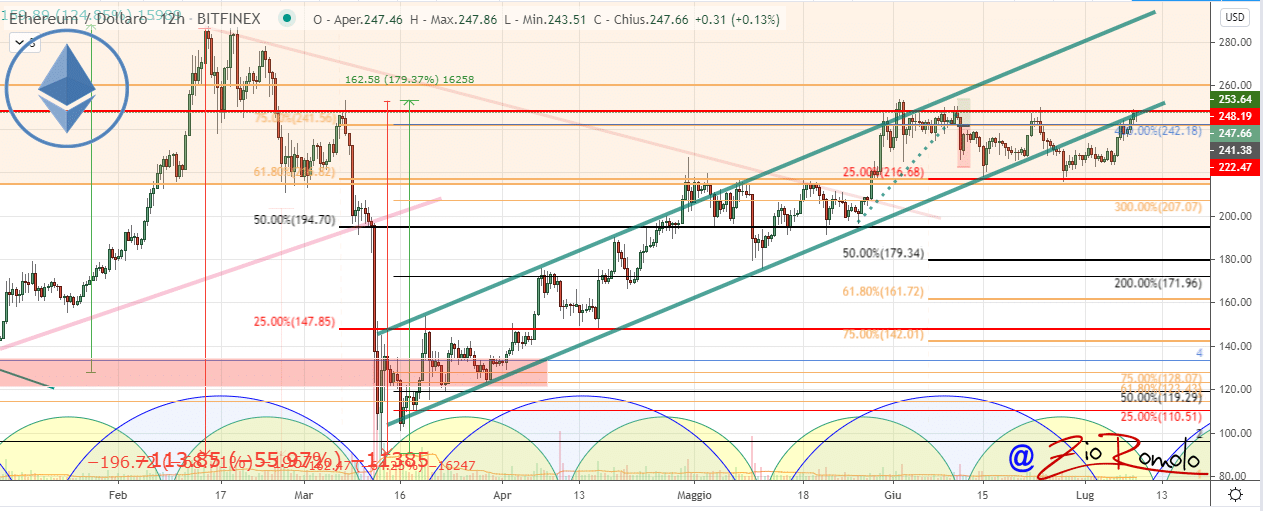

Ethereum (ETH)

Ethereum rises and goes to attack the highs of early June, as well as the highs of the last 4 months, in the $248-250 area.

Ethereum approaches 250 dollars, where protections of the call options have been placed upward for some time now, although in the last two days they have dropped significantly to move to higher levels and to protect against possible declines, where the $215 level remains crucial, despite being now far away.

ETH is showing strength and the break of the 250 would project to test the $260-265 area, levels last recorded at the end of February. Downwards, the $215 remains valid. Only a break of this technical aspect also for the positioning of the options would start to worry and ruin the consolidated bullish trend on Ethereum starting from the middle of March.