After the recent increase in volumes, slow ‘summer’ trading resumes.

Despite this, the entire sector has rebounded and remains green on the last working day of the week. In the ranking of the top 100 cryptocurrencies, only six have the red sign.

To find the first you have to go down to the 57th position occupied by Dentacoin (DCN), the worst of the group with a decrease of about 4%. Restricting the focus to the top 30 of the list, VeChain (VET) stands out above all, with an increase that almost reaches 50%, making VeChain reach 18th place: an increase that in less than three days allows the crypto to recover the decline experienced since the beginning of August that in less than 15 days has lowered prices around 6 thousandths of a dollar (the lowest level since the day of listing on the exchange Binance).

Ontology (ONT) follows with a leap of 40% from yesterday’s levels, returning to capitalize on more than $ 300 million trying to move away from the annual lows.

Total market capitalisation rises to $215 billion with Bitcoin still above 52% dominance. The crypto queen continues to lead the sector, claiming to be worth more than half of all the other 1850 cryptocurrencies currently listed on Coinmarketcap.

VeChain (VET)

The token, which has only been listed on Binance for a few weeks (July 25), supports the VeChain Thor platform, which aims to use blockchain technology in the real world combined with IoT, in order to offer users control over the authenticity of products traced on the register from the manufacturer up until the end consumer.

This objective has also been mentioned several times in other projects that will characterize our near future, such as the traceability of medicines, as reported in today’s article “China: vaccine traceability using blockchain technology“.

The virtual token is currently listed on a handful of exchanges, among the best known: Binance and Huobi. After reaching 2.8 cents of a dollar on the day after Binance’s listing, prices followed the weakness of the sector and reached their lowest level on 14 August at 6 thousandths of a dollar.

The technical structure has a decidedly negative trend and to evaluate the possibility of a possible rebound with a return towards 3 cents, it will be necessary to wait until the next few weeks to have more data that will allow a more accurate reading of the quarterly period.

A primary condition for the recovery will be the construction of a solid support above one cent of a dollar. Despite a drop of almost 80% in a few days, the return on investment (ROI) from the ICO that occurred a few months ago is now over 1700%.

Bitcoin (BTC)

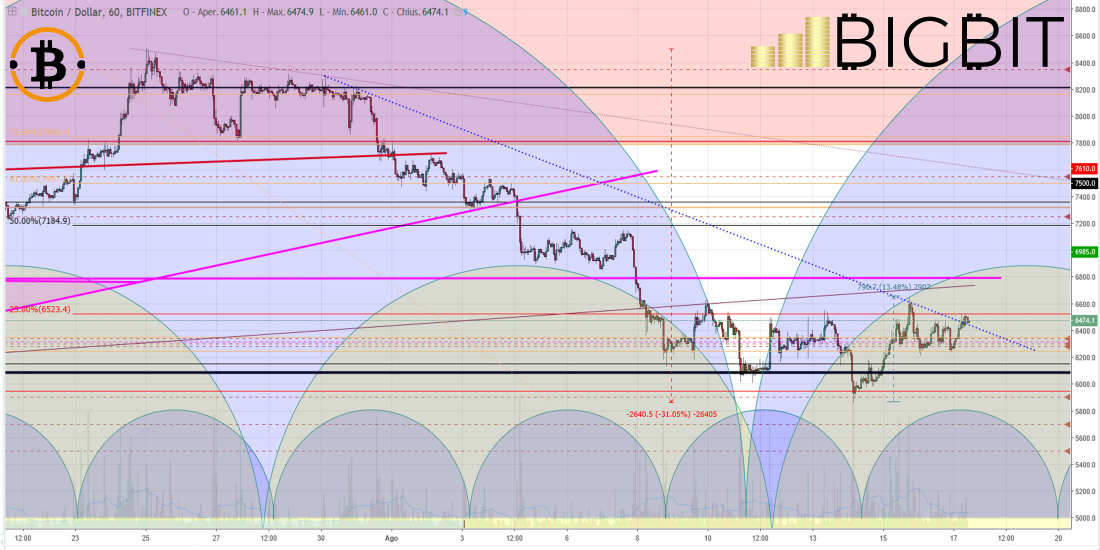

The drop in volumes over the past 24 hours frightens the bullish traders who are trying to push prices above $6,500.

During the last course, these attempts have still not broken the technical and psychological threshold.

Overcoming this barrier, accompanied by volumes, would open the space upwards past Wednesday’s highs at $6650 and start building a short-term bullish structure.

Otherwise, with a return of prices below $6200 in the coming hours, it will be prudent to accept that the bear is still around.

Ethereum (ETH)

The blow Ether suffered during the last week is still strong, when it recorded the deepest decline in the top 15 of the ranking.

The fear is caused by the lack of purchases that so far are unable to exceed the threshold of 300 dollars which has been tested several times in the last 48 hours but that doesn’t attract buyers.

The situation remains precarious despite the rebound that at the moment marks a recovery of 20% from the lows on Tuesday afternoon. Volumes remain above the weekly average, confirming the trading activity that has always been high for over a month.