Thanks to a collaboration The Cryptonomist has with Tradingview, today we are going to check three interesting price analysis some of their traders carried out regarding Ripple (XRP), Cardano (ADA) and of course also Bitcoin (BTC).

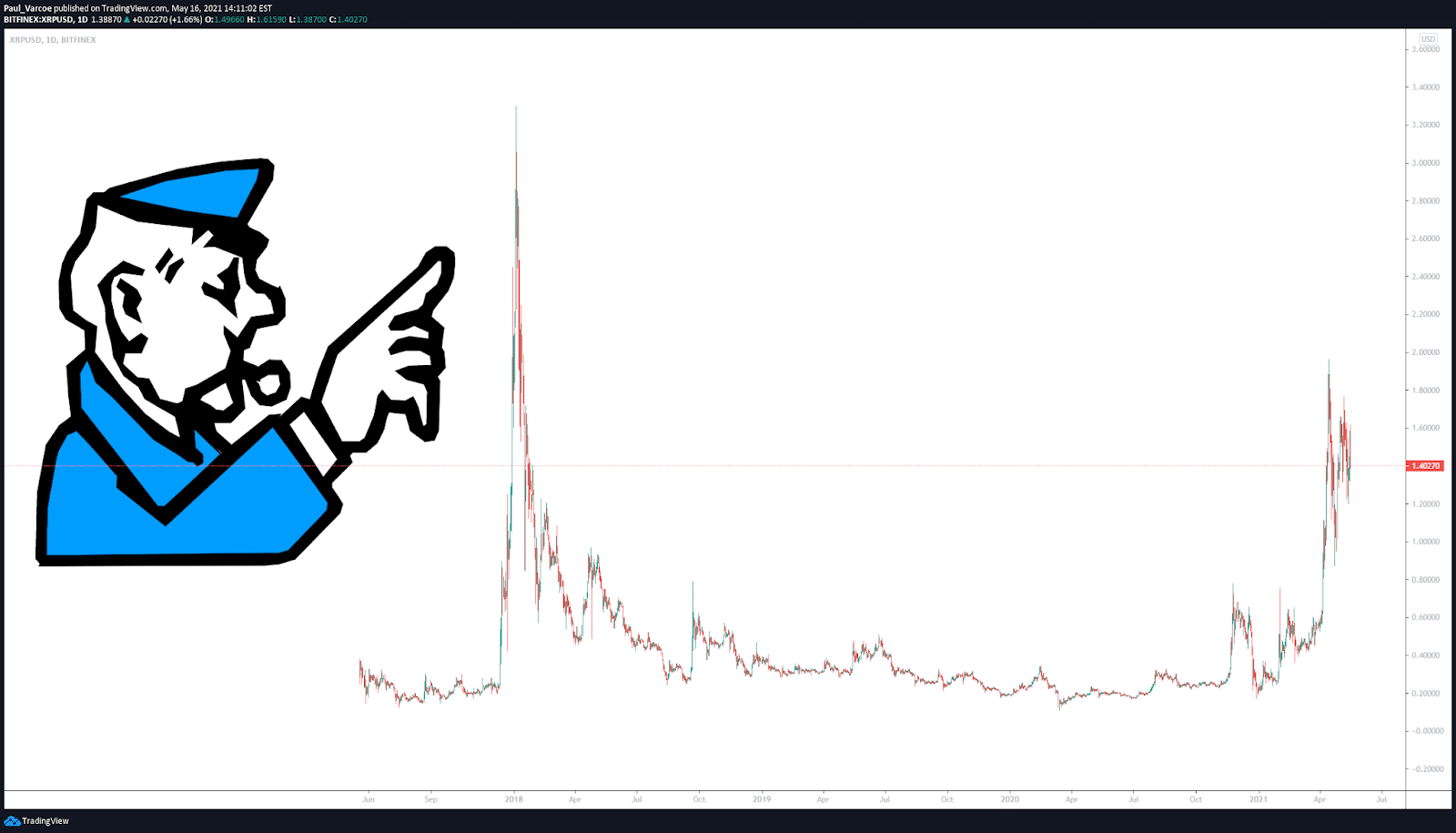

Ripple (XRP) price analysis

In this first Ripple price analysis, the Tradingview trader explained why investors are still interested in buying XRP even if the company has some major issues with the SEC. However, according to the trader, XRP is still cheap.

“There are many ways for the settlement to go, but for me it is hard to see it being so ruinous that Ripple has to close. The fact that it is so obviously a step forward for payments means that investors may well support Ripple to push on, pay a fine and get it all going. Either way XRP looks cheap to me. It has not shared much at all of the recent rally in cryptos across the board”.

Cardano (ADA): solid bullish trading channel

Regarding Cardano (ADA), its price seems not be correlated to the BTC value, but the opposite, as the Tradingview analyst explains:

“One point on ADA that’s important to understand is, unlike most ALTCOIN projects, ADA tends to have a more negative correlation to Bitcoin . Meaning, when BTC is going down or is stagnating, ADA tends to do well.”

Also, the trader continues his analysis giving his own prediction on the ADA price:

“It’s important to watch the BTC strength as that may give us a short-term indicator how much more run-up space ADA may have before settling down and consolidating. Long term, I firmly believe ADA will be $10+ by the end of this Bull Market Cycle.”

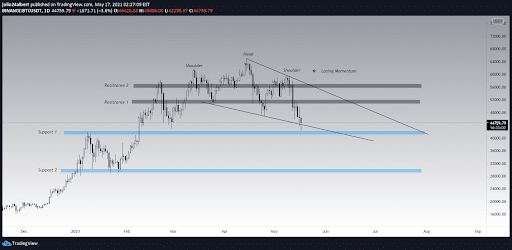

Bitcoin: Elon’s FUD or technical confirmation?

For what concerns Bitcoin, another Tradingview analyst explains that the price is falling not due to the Elon Musk decision not to accept BTC anymore, but to a Head and Shoulder pattern started on May 11st.

“Remember, this is a $800 Billion market capitalization asset which I believe not a single person can change the majority bias for a higher time frame. We actually have seen the sign of potential drop since May 11 when there was a confirmation of lower high structure as the validation of the Head and Shoulder pattern in the daily time frame. The confirmation of lower high and the right shoulder is the sign of losing momentum too. I personally am a technical maximalist and don’t believe in the fundamental because it’s fully manipulative action that becomes the media contents to drive the traffic to its own benefit. The higher time frame’s bias may not change and if you see it from the technical perspective, it’s legit and trusted”.