Leggi l’articolo in italiano qui

In Australia was born the first Crypto Hedge Funds dedicated to cryptocurrencies and ICOs and aimed at small investors.

To launch it, in the third quarter of 2018, the Every Capital investment management company based in the land of kangaroos.

The co-founder, Tom Surman, said that the fund has been simplified to make it accessible to anyone while maintaining an high level of security.

The crypto hedge fund is distributed to investors through a user-friendly platform with a registration system available to everyone.

Users deposit their Australian dollars in exchange for cryptocurrencies and token. The application helps the customer in each phase, tracing the investments made and returning automatic annual reports, including the taxes that has to be paid.

For Jack Baldwin, co-founder and head of communications of Every Capital, hedge funds and specifically “crypto-assets are the future of money, and will bring changes in almost all industries on the planet”.

How the Managed Investment Scheme works

Investment funds in Australia are known as Managed Investment Scheme (MIS) and are regulated by the law (Corporations Act 2001) and monitored by ASIC (Australian Securities & Investments Commission).

A plurality of people can participate, who together contribute to the assets of the fund; in this case a fund of crypto asset.

MIS Every employs the collaboration of Astronaut Capital, an expert in the management of crypto funds, and Global Merces specialists, whose task will be to select the crypto-assets to be added to the fund’s portfolio and find the best Initial Coin Offering in which to invest.

Crypto asset hedge funds: the future of savings

We can call them in many ways: cryptocurrency fund, blockchain fund, digital asset fund. The essence does not change, the crypto funds are growing strongly.

According to a research conducted by Crypto Fund Research, 122 hedge funds of cryptocurrencies were set up in 2017 out of a total of 700: these represent 14% of the total, but they were also the most performing.

The study prospects the birth of another 106 crypto funds in 2018 that will be added to those currently active and can be divided as follows:

313 cryptocurrency fund;

190 crypto hedge funds;

110 crypto venture capital fund.

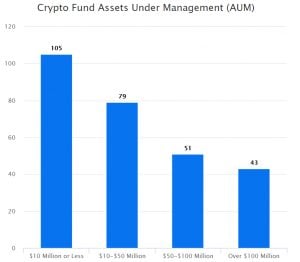

Most of the funds are small, less than USD 10 million, but 43 of the listed funds exceed USD 100 million in managed capital.

The crypto fund industry grew rapidly in 2017 on the wave of euphoria that accompanied the price of bitcoin.

It suffered a slight downturn at the beginning of 2018 due to the contraction of trading activities, also a consequence of the decrease of the price of cryptocurrencies.

Size of companies

What is most striking is the size of companies behind these funds. Most of them are made up of fewer than 5 people: the founder and one or two people that are part of the staff.

Only 12 crypto funds are managed by companies with more than 25 people.

Geographical distribution

As for the geographical distribution, they are mainly located in the United States of America and in Europe.

The cities with the highest presence of crypto funds are:

San Francisco

New York

London

Singapore

Menlo Park

High pole

Chicago

Hong Kong

The most important crypto asset hedge funds

The most important crypto asset hedge funds

The most important cryptocurrency funds on the planet are 10, those where there is more money invested. This is the list in alphabetical order:

Arrington XRP Capital: USD 100 millions

BlockTower Capital: USD 140 millions

Brian Kelly Capital Management: mixed fund crypto-assets and not

Fenbushi Capital: Vitalik Buterin as former advisor

Galaxy Digital Assets Fund: USD 200 millions, founded by Mike Novogratz

The Logos Fund: USD 100 millions, founded by Marco Streng of Genesis Mining

MetaStable Capital: invests only in cryptocurrencies

Pantera Capital: invests in crypto companies

Polychain Capital: USD 250 millions

Protocol Ventures: dedicated to ICOs.